Investment markets remain erratic despite desperately trying to recover from the losses endured since the outbreak of the coronavirus pandemic. But as the virus continues to spread and lockdowns extend, there is growing uncertainty as to when we can expect markets to return to some form of normality.

Some believe the markets will reconfigure and experience a sharp upward trend followed by the return to a cycle of steady growth relatively quickly. Whereas others believe there is a serious risk of a further market crash.

Many investors and advisers are unsure of the best way to proceed, resulting in a default strategy of ‘wait and see’. During extreme periods of uncertainty there are two investment philosophies that come to the fore:

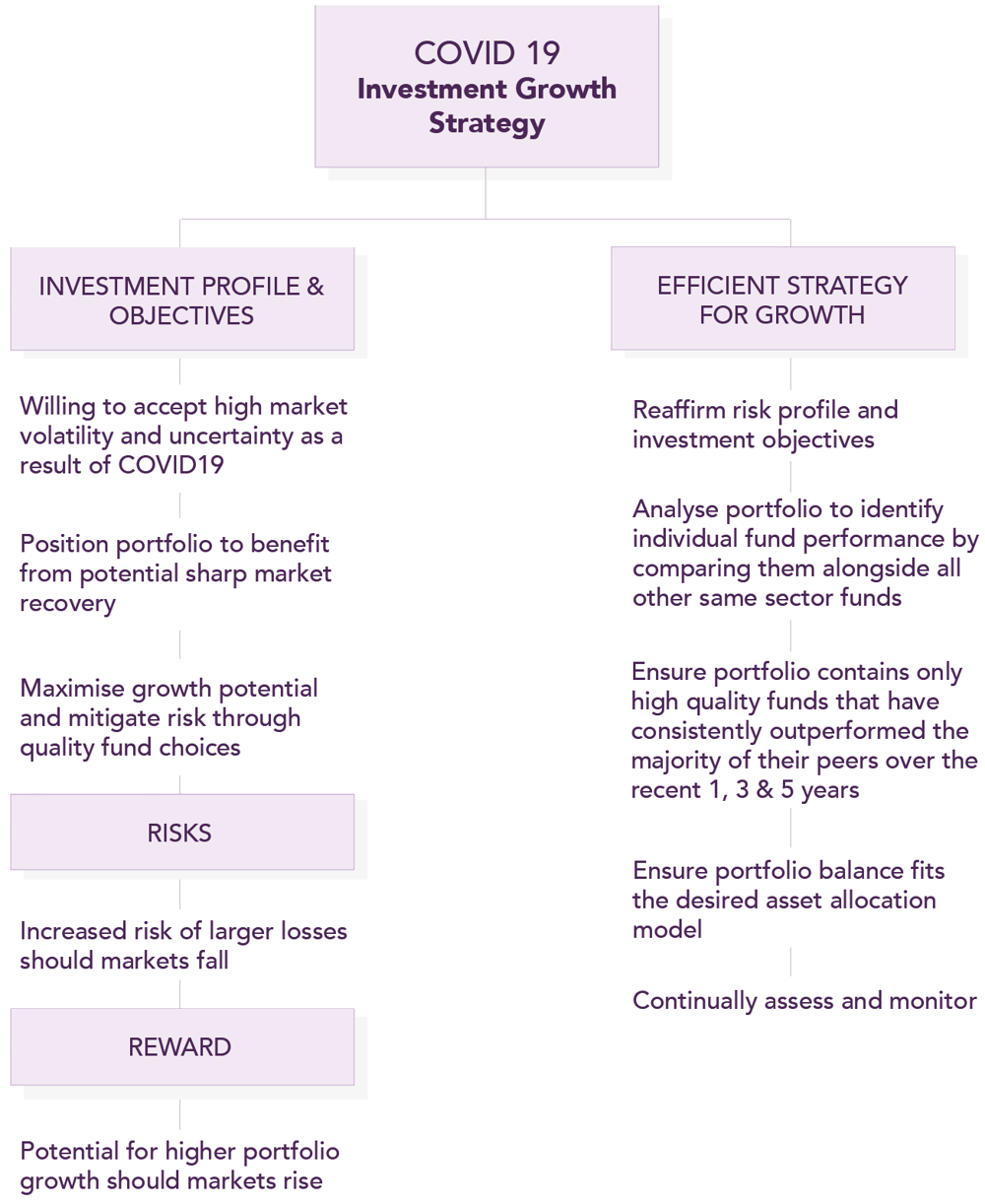

1. A 'growth strategy' that would benefit from market recovery and maintaining the course, and

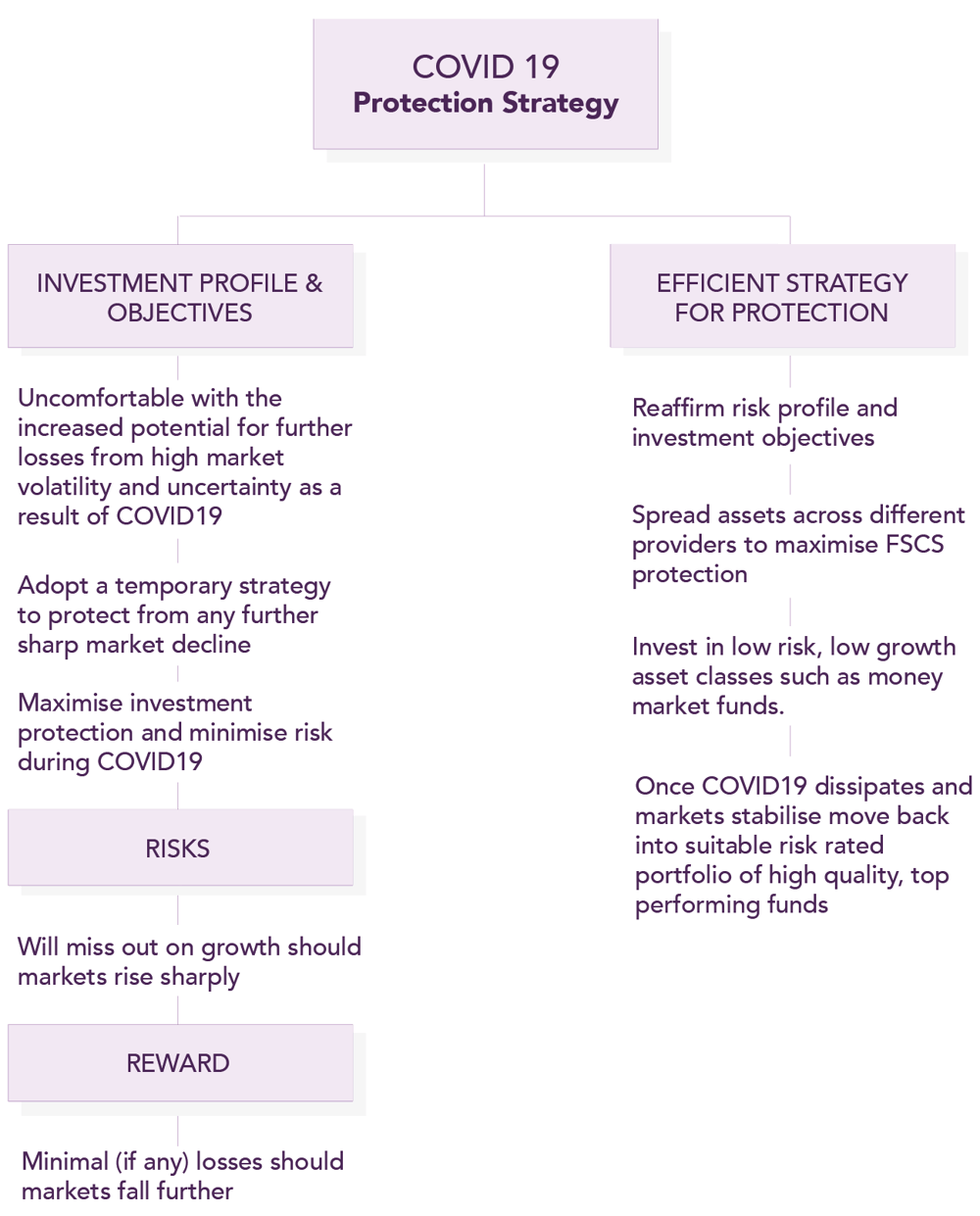

2. A 'protect & recover' strategy that would benefit from protecting capital now to mitigate against further losses.

In this report we evaluate both strategies, and the highlight how to adopt both as efficiently as possible to both mitigate against losses, and benefit from market corrections.

Fear & Uncertainty For Investors

When restrictions on movement and businesses recede, fear will remain over a second wave of the virus - and with lockdown fatigue from weeks of social and economic restrictions, the reintroduction of a second lockdown could potentially have an even bigger impact on the economy, businesses, and investment markets, than the first.

Of course, this may not happen and life, as well as investment markets, could return to some form of normality sooner than might be expected, with the best-case scenario seeing industries back up and running and markets rebounding quickly rewarding investors with a portfolio that is primarily invested in equity markets and higher risk asset classes.

As we wait for clearer skies, many investors will adopt a ‘wait and see’ strategy leaving their portfolio untouched. These are unprecedented times for investors and a time where investment portfolios should not be left to a strategy that is based on hope.

Optimal Investing During Covid19

As investors, we will endure this downturn and learn from it. But whilst in the midst of it, we have 2 options.

1. maintain a strategy for growth, which comes with increased risk of losses during highly volatile and uncertain times.

2. adopt a short-term protection strategy by shifting our portfolios asset allocation towards low risk, more stable asset classes until clarity prevails.

Although they are 2 different strategies, they both require a degree of action to optimise their efficiency. The ‘wait and see’ approach many investors have been advised to stick to is sub optimal.

Investors who wish to maintain a strategy for growth are missing out on an opportunity to identify and replace underperforming funds with better, more consistent alternatives. Investors who are uncomfortable with the increased risk but are being advised to 'wait and see' are exposing their assets to a strategy that simply does not fit their desires.

Maintain A Growth Strategy – Higher Risk, Higher Reward

Undeterred by the added risk that comes from following a 'growth strategy' during such extreme volatility in unprecedented times, many investors believe the opportunities from a large and quick market retraction out ways the risks, and as such, maintain a growth strategy.

The best-case scenario for an investor with this strategy is that the virus dissipates much quicker than anticipated, removing all restrictions on movement and trade which would facilitate a swift market recovery that could yield large returns for investors.

The risks? That the virus continues to spread, prolonged periods of lockdown, if lockdowns are prematurely lifted and need to be reintroduced, industries begin to fail, global recession and unemployment. Each of these outcomes could facilitate a further market drop that would leave investors who follow this strategy exposed to greater losses.

To help maximise the reward from a strong market recovery and mitigate losses from a further market slump, investors in this strategy should use this opportunity to assess the quality of funds that makes up their portfolio.

Research shows that a strategically weighted portfolio that contains the best performing funds which have consistently outperformed their peers over the recent 1, 3 & 5year periods deliver above average returns in times of growth and experience lower declines when markets fall.

Is A Quick Recovery Now Unlikely?

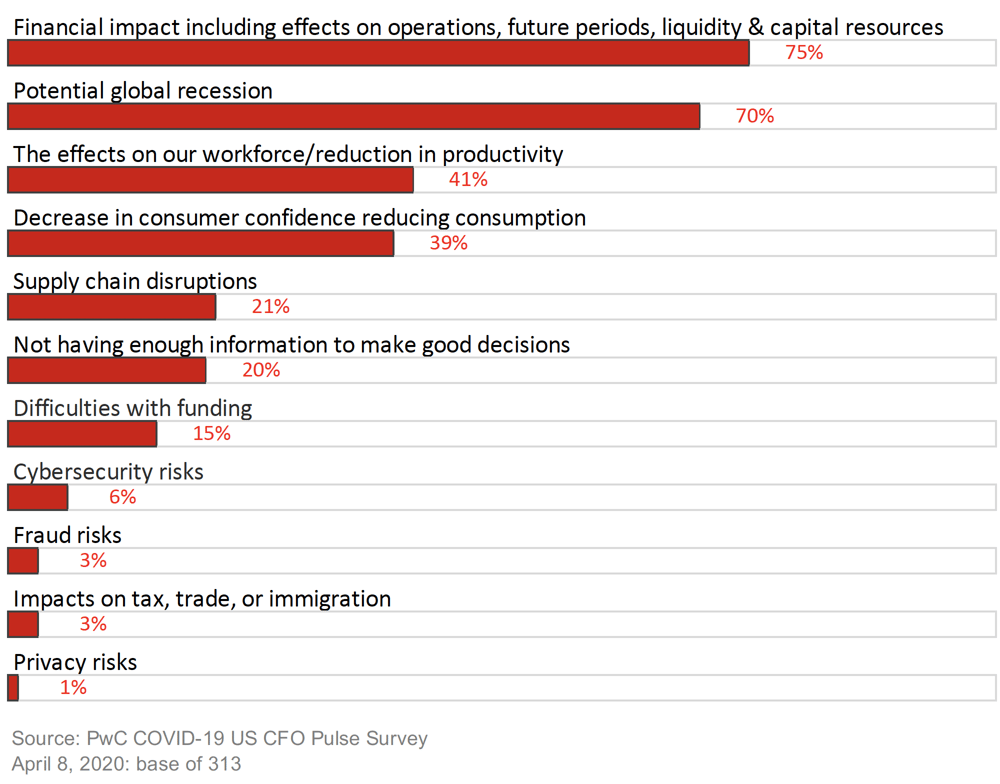

For businesses, the hope of a quick recovery is receding. Businesses are actively dealing with the effects of a sharp drop in economic activity and are assessing the lasting effect on recovery scenarios.

Workforces have been scattered, and customer interactions have been affected. This will complicate recovery time frames for many companies, which must also try to predict what business as usual will look like once the outbreak ends, including what aspects of life under lockdown might persist. There are many concerns business leaders face that could impact the time it takes for them and their industries to recover.

A recent survey by Price Waterhouse Cooper of 313 US finance leaders tracks how they view COVID-19 will impact on business and their fears for the future.

Adopting A Temporary Protection Strategy

For some investors, the risk of maintaining their pre pandemic investment strategy during the current climate is too great. The potential gains from a sharp market recovery should the virus dissipate quicker than predicted is outweighed by the risk of further losses from extended or secondary lockdowns, and the stresses this will put on people, business and the economy.

Although maintaining confidence in a long-term investment strategy during difficult market conditions is typically the most sensible plan, and one that is primarily recommended, these are extreme conditions. There is potential for huge reward and huge losses but until there is greater clarity, a temporary strategy focused on protection could be the most sensible for those uncomfortable with the excess risks posed in the current climate.

Such a strategy should be viewed as a temporary measure to protect investors from the potential of further sharp market falls as a result of the coronavirus pandemic. As soon as clarity and stability returns, they should move back into a suitable risk-based portfolio that fits their longterm investment objectives.

The aim of this strategy is to maximise protection, and the most efficient way to achieve this is to invest in low risk asset classes, spreading the weighting of assets across several different providers in order to maximise the protection afforded by the Government's Financial Services Compensation Scheme (FSCS).

The FSCS is the UK’s statutory compensation scheme for customers of financial products that have failed as well as protecting cash held in banks and building societies. But due to its £85,000 protection limit per provider, tens of thousands of investors and billions of their assets are overexposed and not protected. If you are invested with, or hold cash with one provider, anything above the FSCS threshold will be exposed and not protected, which is why a strategy that utilises several different providers offers greater protection.

Don’t Panic, But Be Prepared

If the impact of the virus can be ‘successfully’ managed, or is less profound than the more extreme scenarios, global equity markets could see a sharp recovery in the latter half of 2020. If not, we will likely see a different path of market recovery. The disruptive effects from the virus are likely to be pronounced and it will take considerable time for business and consumer confidence to recover.

For investors it is important not to panic buy or sell, but to take a measured approach that takes into account your current as well as future objectives. As we have illustrated, there are 2 primary strategies that investors can take, both of which have risk and reward. Depending on the strategy that is right for you it is important to prepare and use this opportunity to refine and improve your portfolio. As ultimately, preparation reduces fear and improves outcomes.