- 42 of Standard Life’s 365 pension funds consistently outperformed their peers over the past 1, 3 & 5 years.

- Our free download identifies the performance, sector ranking and performance rating of all 365 Standard Life pension funds.

- The Standard Life MyFolio and Active Plus pension range have been among the best performing funds on the market

- 73% of Standard Life pension funds have a history of underperformance, with 138 receiving a poor one-star rating.

This article highlights the top-performing Standard Life pension funds, as well as those that have performed poorly in their specific sectors. Our comprehensive analysis covers 356 Standard Life pension funds, evaluating their performance and sector rankings over the past 1, 3 and 5 years. Through this process, we identified 42 funds that consistently excelled in their respective sectors, achieving impressive four or five-star performance ratings.

From these 42 top performers, we highlight the 10 best Standard Life funds based on their performance, sector ranking, and overall ratings over 1,3 & 5 years. We also provide access to a comprehensive report that features the performance, sector ranking and rating of all 356 Standard Life funds.

Standard Life Fund Performance Summary

Standard Life's extensive range of 356 pension funds spans multiple investment sectors, making it essential to evaluate each fund's performance against its sector peers to fully understand their effectiveness.

From their extensive range of 356 pension funds, 42 were awarded an impressive 4 or 5-star performance rating and 54 had a modest 3 star rating. However, more than half of the pension funds have a history of poor performance, with 138 funds receiving a one-star rating and 122 funds receiving a two-star rating. This indicates that a significant portion (73%) of their funds underperformed relative to their peers.

For an in-depth analysis of all 356 Standard Life funds, including detailed performance data, sector rankings, and ratings across 1, 3, and 5 years, download the full PDF analysis.

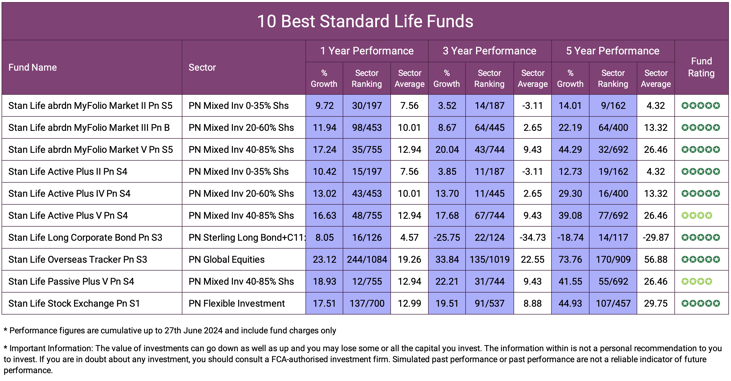

10 Best Standard Life Funds

The table below lists 10 of the best Standard Life funds over the past 1, 3 & 5 years. Each of these 10 funds have an impressive history of top performance relative to their sector peers with each consistently ranking among the best performing funds in their sectors.

1. Stan Life abrdn MyFolio Market II Pn

The Stan Life abrdn MyFolio Market II Pension Fund, which currently manages approximately £457.6 million of client assets, is designed to generate long-term growth while maintaining a defined level of risk. The fund employs a multi-asset investment strategy, combining various asset classes such as equities, bonds, and alternative investments to achieve its objectives.

As identified in our analysis, the fund's strategy has resulted in performance that consistently ranked among the best in its sector. Over the past 1, 3, and 5 years, the fund has delivered impressive growth of 9.72%, 3.52%, and 14.01% respectively. In comparison, the sector average for these periods was 7.56%, -3.11%, and 4.32%, further showcasing the fund's strong performance.

2. Stan Life abrdn MyFolio Market III Pn

The Stan Life abrdn MyFolio Market III Pn B Fund is a robust investment strategy ideal for investors seeking balanced exposure to equities and fixed income, with a moderate risk profile suitable for long-term growth. The fund manages £1.15 billion of clients' money, with 60% invested in equities and the remaining in other assets (bonds, cash, and property).

Our analysis shows that the fund's strategy has led to performance consistently ranking among the best in its sector. Over the last 1, 3, and 5 years, the fund has returned growth of 11.94%, 8.67%, and 22.19%, respectively, compared to sector averages of 10.01%, 2.65%, and 13.32%.

3. Stan Life abrdn MyFolio Market V PN

The Stan Life abrdn MyFolio Market V Pension fund, which manages £338.89 million, is designed for high-risk investors seeking substantial long-term growth. Unlike more balanced funds, which include a higher proportion of fixed-income securities, this fund is heavily weighted towards equities, allocating between 40% to 85% of its portfolio to this asset class. The objective of the fund is to achieve significant capital appreciation by focusing on high-growth sectors and global markets.

The fund has consistently ranked among the top in its sector, with 1, 3 & 5 year growth rates of 17.24%, 20.04%, and 44.29%, respectively, outperforming sector averages of 12.94%, 9.43%, and 26.46%.

4. Stan Life Active Plus II Pn

The Stan Life Active Plus II Pension Fund is a dynamic investment strategy aimed at long-term growth through a diversified portfolio of equities, fixed income, and alternative investments. With a substantial allocation to equities (60-70%), the fund focuses on global markets, selecting companies with strong growth potential and solid fundamentals.

As identified in our analysis, the fund's strategy has resulted in performance that consistently ranked among the best in its sector. Over the past 1, 3 & 5 years the fund has returned growth of 10.42%, 3.85% and 12.73% respectively. To put the quality of this performance into perspective, the sector average for the same period was 7.56%, -3.11% and 4.32%.

5. Stan Life Active Plus IV Pn

The goal of Stan Life Active Plus IV Pension fund is to achieve long-term growth while maintaining a specific level of risk, rather than focusing on a particular return level. It holds a diverse mix of equities, bonds, non-residential property, and alternative investments. The fund invests over 60% in equities, focusing significantly on global markets including emerging markets, and manages £0.02 million in assets. This fund is suitable for investors who are comfortable with risk and seeking higher long-term returns despite potential value fluctuations.

Over the past 1, 3 & 5 years, it has achieved returns of 13.02%, 13.70%, and 29.30%, respectively. In comparison, the sector averages for these periods were 10.01%, 2.65%, and 13.32%. Our analysis shows that the fund has consistently ranked among the top performers in the PN Mixed Investment 20-60% Shares sector.

6. Stan Life Active Plus V Pn

The Stan Life Active Plus V PN S4 stands out due to its strategic focus on high-growth sectors and regions, utilising a substantial equity allocation of 40-85% to maximise returns. This fund is designed to be the highest risk option in its range, heavily investing in high-risk assets like equities and property. It allocates less to lower-risk investments such as money market instruments and certain types of bonds.

Notably, over the past 1, 3, and 5 years, the fund has achieved impressive growth rates of 16.63%, 17.68%, and 39.08%, respectively, outperforming sector averages. This unique combination of aggressive equity focus and robust growth potential makes it ideal for investors seeking substantial returns despite higher risks.

7. Stan Life Long Corporate Bond Pn

Launched on 3rd October 2001, this fund currently manages £2.03 billion in assets. The Stan Life Long Corporate Bond Pension fund primarily invests in long-term sterling-denominated corporate bonds, with a typical maturity greater than 10 years. The fund aims to achieve long-term growth by reinvesting income generated from these bonds. It is actively managed and may include other bonds and money market instruments.

Over the past year, it achieved an 8.05% growth, significantly outperforming the sector average of 4.57%. Although the fund posted negative returns of -25.75% and -18.74% over the 3 and 5-year periods, respectively, it still surpassed the sector averages of -34.73% and -29.87%. Despite challenging market conditions, the fund's conservative strategy has performed relatively well, earning a 5-star rating that highlights its robust performance and potential for long-term recovery.

8. Stan Life Overseas Tracker Pn

The fund aims to deliver returns that match the MSCI World ex UK index by reinvesting dividends. It invests in index-tracking funds that cover major global stock markets, excluding the UK, with each region's allocation reflecting its proportion in the index. This strategy provides diversified international exposure, aiming for long-term capital growth while maintaining low costs and high liquidity. The underlying assets are primarily managed by Vanguard Asset Management, a renowned global provider of tracker funds. As of March 2024, the fund's size is £831.39 million.

Our analysis shows it was the highest growth fund featured in the above table, with very strong returns of 23.12%, 33.84%, and 73.76% over the 1, 3 & 5 year periods, respectively. This outperformance highlights the fund's effective strategy and strong returns in the global equities market, making it one of the best among Standard Life funds.

9. Stan Life Passive Plus V Pn

The Stan Life Passive Plus V pension fund adopts a passive investment strategy aimed at delivering long-term capital growth through a diversified portfolio of global equities, bonds and other investments with 40-85% in shares. The fund balances risk and returns by adjusting its asset allocation based on market conditions, providing investors with a steady growth potential while maintaining moderate risk exposure.

The fund’s strategy has led to outstanding performance, consistently ranking among the best in its sector, with a growth of 41.55% over the past 5 years, which is considerably better than the sector average of 26.46%.

10. Stan Life Stock Exchange Pn

The Stan Life Stock Exchange Pn S1 fund, with a fund size of approximately £1.273 billion, is designed for investors seeking long-term growth and exposure to global equity markets, including significant investments in the UK (about 40% of the portfolio). Classified under the Flexible Investment sector, the fund primarily targets large and medium-sized companies listed on UK stock markets, providing a diversified investment strategy with a strong UK market presence.

Over the past 1, 3 & 5 years, it has delivered impressive growth of 17.51%, 19.51%, and 44.93%, respectively. In comparison, the sector averages for these periods were 12.99%, 8.88%, and 29.75%.

Summary

Standard Life, established in 1825 and now managed by Phoenix Group, has for generations been one of the leading pension providers in the UK. With their long-standing reputation, diverse investment strategies, experienced fund managers, and large allocation of top performing funds they continue to provide a diverse offering to UK investors.

Although they have a large selection of top performing funds, as identified in our full analysis of all 356 of their pension funds, the majority have shown poor to mediocre results. Establishing which funds have a history of strong performance can help determine which funds have the most quality and potentially more likely to provide better longterm investment opportunities. Download the complete analysis of all 365 Standard Life pension funds to identify exactly how each of their pension funds have performed and how they rank.

Download The Full Standard Life Pension Fund Review

Why Performance History Is Important

Evaluating fund performance is a critical metric for investors and reputable advisory firms. Performance analysis ensures portfolios effectively align with investment objectives while entrusting assets to fund managers with a track record of generating above-average returns. Though past performance does not guarantee future results, investors often exhibit a preference for fund managers with a history of excellence across various time horizons. Our best funds report features the top-performing funds managed by managers who have consistently outperformed the majority of their peers over the past 1, 3 & 5 years, with many sustaining outperformance over multiple time periods.

Comparative Benchmarking

Each fund's performance can be assessed relative to competing peer group funds classified under the same sector. This comparative analysis across multiple time horizons provides insights into a fund’s overall quality and the capabilities of its management team.

Manager Skill

Historical returns serve as an indicative gauge of a fund’s efficacy and the competencies of its managers. Funds able to consistently maintain a high ranking within their respective sectors over time typically signal a notable level of expertise. Conversely, fund managers overseeing perennially lagging funds showcase deficiency in quality and an inability to deliver competitive returns. While past performance alone cannot predict future returns, it is a valuable tool to assess manager skill.

Navigating Market Cycles

Over a multi-year span, investments traverse various economic and political environments. How capably a fund and its managers navigate these cycles offers clues into their abilities and competence.

Efficient Investing with Yodelar

No one fund manager will outperform all the time, which is why we believe it's important to diversify across a range of quality fund management brands.

Our portfolio development is based on years of exhaustive analysis of the fund universe and managers. We evaluate over 100 managers, tens of thousands of funds, and 30,000 model portfolios. Our ongoing research shows that only a small subset of funds and managers consistently outperform, with over 90% of portfolios containing chronic under-performers.

These data-driven findings inform our structured portfolio construction process, utilising top-tier, proven funds within each asset class based on rigorous backtesting.

To find out more, book a no-obligation call with one of our advisers to explore your options and learn how we can help you enhance the returns on your portfolio.