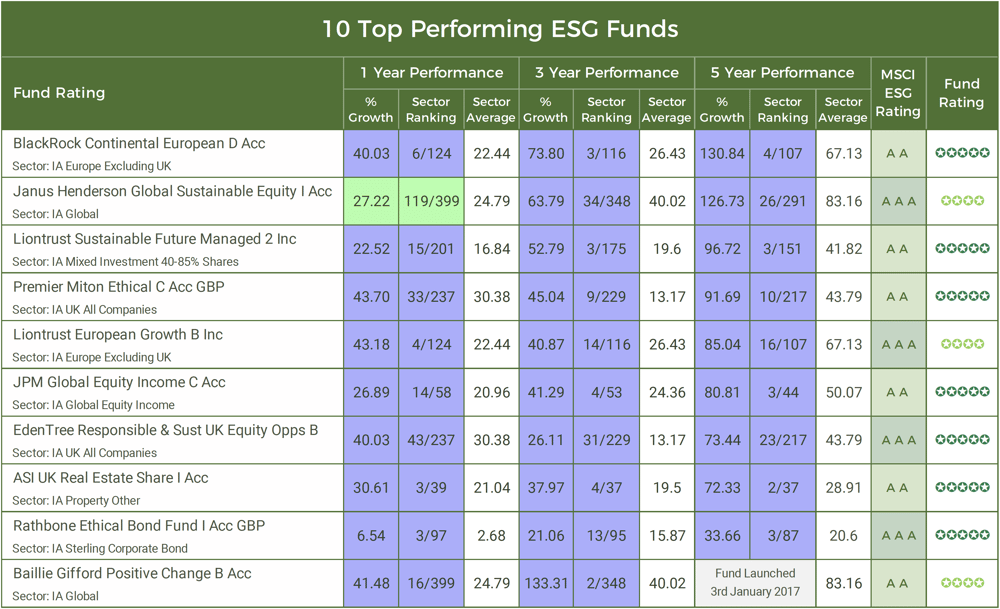

- Over the past 5 years the Liontrust Sustainable Future Managed fund has outperformed 99% of funds in its sector with growth of 96.72%.

- Since its launch in 2017 the Baillie Gifford Positive Change fund has achieved more than double the growth of the Fundsmith Equity fund.

- The BlackRock Continental European fund has consistently been one of the top performing funds in its sector over the past 10 years.

Until recently, investors who wished to invest their money in funds that follow an ethical and sustainable framework would be expected to sacrifice an element of portfolio growth in return. But over the past several years this has changed.

Climate change has become a core topic of global politics with many governments putting in place adventurous targets on reducing their carbon footprint in the coming years. As a consequence, many industries have invested significantly in re-engineering their proposition; this challenge has created opportunities for new entrants into previously established markets, with Tesla being one of the most notable.

The global acceptance and the growing adoption of environmentally sustainable processes has fuelled innovation and made it much easier for fund managers to offer sustainability themed funds that challenge and exceed the performance of traditional funds that have followed an unrestricted investment framework - The 10 funds featured in this report are evidence of that.

Each of the 10 best performing ESG funds in this report represent some of the top performing funds on the market that also happen to maintain a high ESG rating.

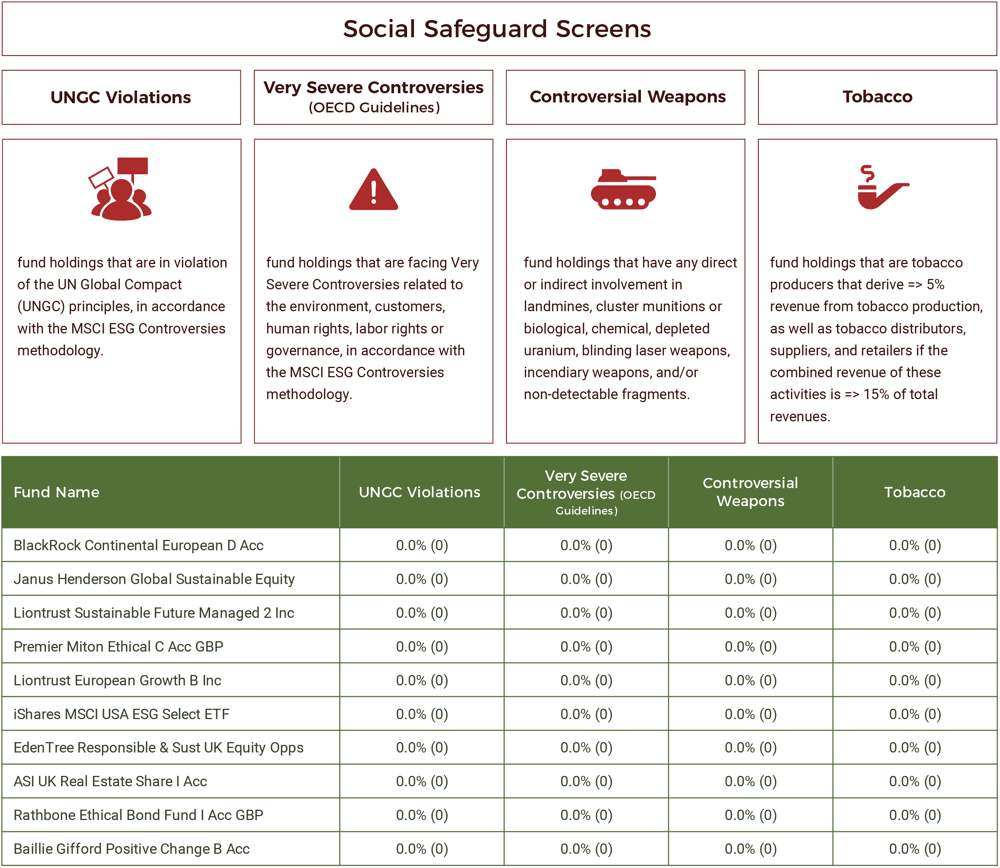

Each of the 10 funds featured in this report have an MSCI ESG rating of A, AA or AAA and as identified in the social safeguard screening chart below all of the funds have a clear screening record.

The following 10 funds are not listed in any particular order.

1. Baillie Gifford Positive Change Fund

Baillie Gifford believes that capital thoughtfully and responsibly deployed is a powerful mechanism for change. With their Positive Change fund Baillie Gifford actively seeks out companies whose products and services are providing solutions to global challenges. They use the United Nations Sustainable Development Goals to help identify and measure the contribution that individual companies are making to solving global challenges.

There are many ways in which businesses can support the transition to a more sustainable world for current and future generations. For their Positive Change fund, Baillie Gifford uses four impact themes to measure how companies address global challenges and how they each contribute towards a sustainable future.

Social Inclusion

260 million children worldwide have no access to education and through their Positive Change fund, Baillie Gifford aims to invest in companies that help address this issue and promote a more inclusive society by improving the quality and accessibility of information. One such company being Alphabet which is the parent company of Google and Loon, which provides internet access via high altitude balloons.

Environment & Resource Needs

Baillie Gifford sees human activities as the biggest detrimental impact on the environment, such as climate change, which can limit global development, They believe the solution to such problems is to invest in and promote the growth of companies that can reduce the environmental impact of economic activities and increase resource efficiency. One such company that Baillie Gifford believes meets this criteria is renewable energy firm Orsted.

Healthcare & Quality of Life

Baillie Gifford sees the biggest challenge to the modern healthcare system is that it remains reactive rather than proactive. They believe that medical research companies such as Illumina, who specialise in providing human genome sequencing tools, can aid in the understanding and prevention of diseases as well as advance medical treatments.

Base of The Pyramid

Baillie Gifford refers to the challenges faced by the world's least affluent people; in particular the 4 billion people globally who live on annual incomes of less than $3,000 as 'base of the pyramid'. To help this demographic, Baillie Gifford aims to invest in companies that provide low cost healthcare and basic goods or finance companies who help finance low income individuals potentially kickstart ventures that can increase their income.

The Baillie Gifford Positive Change fund is still in its infancy, but since it launched in January 2017, it has returned 292.80%, which is the highest in its sector. To put this performance into context, the most popular fund in the Global sector is the Fundsmith Equity fund. Over the same time period the Fundsmith Equity fund returned growth of 117.02%.

2. Janus Henderson Global Sustainable Equity

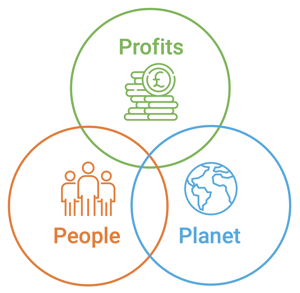

Janus Henderson select the stocks within their Global Sustainable Equity fund after taking into account how they each generate their profit and the impact their processes have on people and the planet.

The Fund invests at least 80% of its assets in companies, of any size, in any industry, in any country. The Fund invests in companies whose products and services they consider to be contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy. Each company is analysed and selected after taking into account how they generate their profits and how this impacts on people and the planet.

For this fund, Janus Henderson avoids investing in companies that they consider to potentially have a negative impact on the development of a sustainable global economy. The Janus Henderson Global Sustainable Equity fund is one of 5 funds in this report that is classified within the competitive IA Global sector. Although its performance is not quite that of the Baillie Gifford Positive Change fund or indeed the Guinness Sustainable Energy fund, it has still consistently ranked among the top performers in the sector.

Over the past 1, 3 & 5 years this fund has returned growth of 27.22%, 63.79% and 126.73% respectively, each of which are comfortably above the IA Global sector average.

3. Liontrust Sustainable Future Managed Growth 2 Acc

In 2001, Liontrust launched their Sustainable Futures range of funds in the belief that the companies that will survive and thrive are those that help to build a more stable, resilient and prosperous economy by improving people’s quality of life through ethical and sustainable means. ]

The investment process for their Sustainable Future funds is to invest in companies positively exposed to long-term transformative themes and to limit or completely avoid investment in companies exposed to activities that cause damage to society and the environment.

Almost two thirds of the portfolio is invested in the US, with information technology, healthcare and financials the most favoured sectors. Among the biggest holdings are Visa, a card payment specialist, Thermo Fisher Scientific, which makes instruments and healthcare equipment, and Ecolab, which specialises in water, hygiene and energy-efficiency products.

Over the past 1, 3 & 5 years the Liontrust Sustainable Futures Managed Growth fund has achieved growth returns of 22.52%, 52.79% and 96.72%, each of which were significantly higher than the sector average and better than at least 75% of all other funds within its sector.

The Liontrust Sustainable Investment team are confident that their fund’s very competitive performance will continue as they believe there is a clear opportunity for growth in the companies helping with the transition to a more sustainable, zero-carbon world in the coming years, with massive change required from many of these sectors as they work to overcome the hurdles from the fossil fuel industry.

4. BlackRock Continental European

The European stock market isn’t renowned for its growth opportunities. Like the UK, it’s generally thought to be more exposed to cyclical value stocks, famous for its carmakers, industrial and energy companies.

But for the managers of the BlackRock Continental European Fund, Europe holds a host of opportunities for the defensively minded. They’re attracted to businesses that can grow regardless of the wider economic environment, so the fund has the ability to hold up well when the economy stalls and offer investors the sort of defensive protection they may usually associate with markets overseas.

Holding between 30-60 stocks, the duo form part of a large group of portfolio managers and analysts at BlackRock covering the European universe.

The fund’s defensive characteristics helped it through the worst of last year’s pandemic-induced volatility. The managers kept the core of their portfolio intact amid the springtime sell-offs, trusting that a recovery would eventually come and that their holdings would prove robust in the meantime. They also saw the period as a buying opportunity, taking positions in attractive companies whose valuations had previously kept them out of reach.

5. Premier Miton Ethical Fund

Launched in 1986, the Premier Miton Ethical fund has consistently featured among the top performing UK equity funds whilst also adhering to a strict ESG model that ensures the fund only invests in companies that contribute to the requirements of a sustainable, civilised society and whose products or services are of widespread benefit to the community.

The fund is widely regarded as one of the most consistent high quality UK Equity funds on the market. This is supported by the funds performance history which over the short and long term has been highly competitive. Indeed, over the past 10 years the Premier Miton Ethical fund has returned cumulative growth of 240.15%, which was more than double the sector average of 107.92%.

6. Liontrust European Growth

The Liontrust European Growth fund aims to deliver growth over the long term by using the Cashflow Solution process that is managed by the Liontrust Cashflow Solutions team. The process is based on the belief the most important determinant of shareholder returns is company cash flows. The fund managers invest in companies that generate strong cash returns from their capital, appear cheap on those cash flows and are run by managers committed to an intelligent use of capital.

Since its launch in December 2012, the fund has amassed modest funds under management of £308 million. For the most part, the fund has had an unremarkable performance history with returns rarely reaching the levels of more established top performers such as the BlackRock Continental European fund. However, since the onset of the pandemic the funds management philosophy has helped it to capitalise on value opportunities which has powered the fund towards the top of the European sector for performance.

7. iShares MSCI USA ESG Select ETF

The iShares MSCI USA ESG Select ETF seeks to track the investment results of an index composed of U.S. companies that have positive environmental, social and governance characteristics as identified by the index provider.

The fund tries to balance environmental, social, and governance integration with the benefits of a broadly diversified portfolio which is predominantly made up of large and mid cap US companies that meet their ESG criteria. It has a (AA) MSCI ESG rating and it is classified within the large Global ETF Equity - USA sector where it has consistently maintained competitive performance. Over the past 1, 3 & 5 years this fund has returned growth of 30.91%, 66.94% and 124.18% each of which well above the sector average.

8. EdenTree Responsible and Sustainable UK Equity Opportunities B

The EdenTree Responsible and Sustainable UK Equity Opportunities Fund aims to invest at least 80% in a range of UK incorporated companies whose primary listing is in the UK, which the Manager believes offer good potential for long -term capital growth. Although it can invest in companies of any size, EdenTree Responsible & Sustainable UK Equity is very different from many of its peers as it invests in a large proportion of smaller and medium-sized companies.

The fund has proven its ability to deliver competitive returns in the long term as since the fund launched in September 1999, it has returned exceptional growth of 501.17%, which is significantly higher than the sector average for the same period of 216.35%. In the short term it has also excelled. Over the past 1, 3 & 5 years the fund has consistently outperformed 90% of the funds in its sector.

9. ASI UK Real Estate Shares

There are limited funds within the property sector that have strong ESG convictions but one of the most prominent is the ASI UK Real Estate fund. Property funds have been out of favour for some time but in recent months the sector has enjoyed strong growth with the sector averaging growth of 15.65% this past 6 months, and the ASI UK Real Estate fund returning an impressive 23.12%. The fund is invested primarily in British property development companies with over 80% of its holdings in such companies.

The fund has consistently enjoyed competitive performance in a sector that has experienced its fair share of uncertainty. Over the past 1, 3 & 5 years the fund has returned cumulative growth of 30.61%, 37.97% and 72.33%, each of which were comfortably above the sector average.

10. Rathbone Ethical Bond Fund

Launched in 2002, the Rathbone Ethical Bond currently manages £1.275 billion of client assets and is one of the most popular funds in its sector with an ethical criteria. The objective of the fund is to provide a regular, above average income through investing in a range of bonds and bond market instruments that meet strict criteria ethically and financially, with insurance, Banking and Social Housing making up the top 3 sectors where this fund invests.

The managers assess the economic environment to decide which industries they want to focus on before identifying potential holdings using the “four Cs plus” approach. This process looks at whether managements of companies which have issued a bond have integrity and competence (character), and whether the bond issuer is avoiding over borrowing (capacity). Jones and his team also assess the agreements on a company’s debt (covenants) and can take big bets that differentiate the fund from the market (conviction).

Over the past 1, 3 & 5 years the fund has ranked among the top performers in the sterling corporate bond sector with growth of 6.54%, 21.06% and 33.66%.

The Best ESG Funds

The 10 funds featured in this report are just a small selection of the quality ESG investment opportunities available to UK investors.

However, there are over 53,000 funds and ETFs that have been provided with an MSCI ESG rating. A selection of these funds will have an ‘A’ plus ESG rating, but less than 10% will have consistently outperformed competing funds within their sectors and have a high performance rating.

Finding the most suitable ESG rated funds then building and maintaining a diversified portfolio of high quality funds to fit defined risk criteria requires significant analysis and continuous monitoring, which is simply not a viable option for many investors or advisers. However, we have complied a report that features over 800 funds that have been filtered from an analysis of over 53,000 funds based on their ESG criteria and performance rating. These funds represent some of the top performing funds in their sectors with a yodelar performance rating of 4 or 5 stars while also maintaining an ‘A’ plus MSCI ESG rating.

Download the Top Performing ESG Funds Report >>

Is ESG Investing The Future

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors. The past months have been a difficult one for many investors and indeed since the pandemic outbreak in 2020 markets have been volatile with fund performance up and down.

But as the world moves closer towards the end of the pandemic the outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth; and with greater accessibility to online fund performance and ESG rating tools as well as growth focused ESG portfolios, it has never been easier to invest in high quality, sustainable funds.