Key Findings

* With 21 of their funds featured in our best funds report, Liontrust has the largest range of top-performing funds out of any other fund manager in the UK.

* The Technology & Telecommunications sector has the highest average growth figures over the past 5 years (211.98%.

* The UK Smaller Companies sector had the highest sector average over the past 12 months by a considerable margin with funds in this sector averaging growth of 52.45%.

* The consistently top-performing fund with the highest 5-year growth was the Baillie Gifford American fund with growth of 361.99% in the 5 years up to 31st August 2021.

The Best Funds

There are more than 3,400 investment funds available to UK investors, yet only a small selection of these funds consistently outperform the market and their competitors.

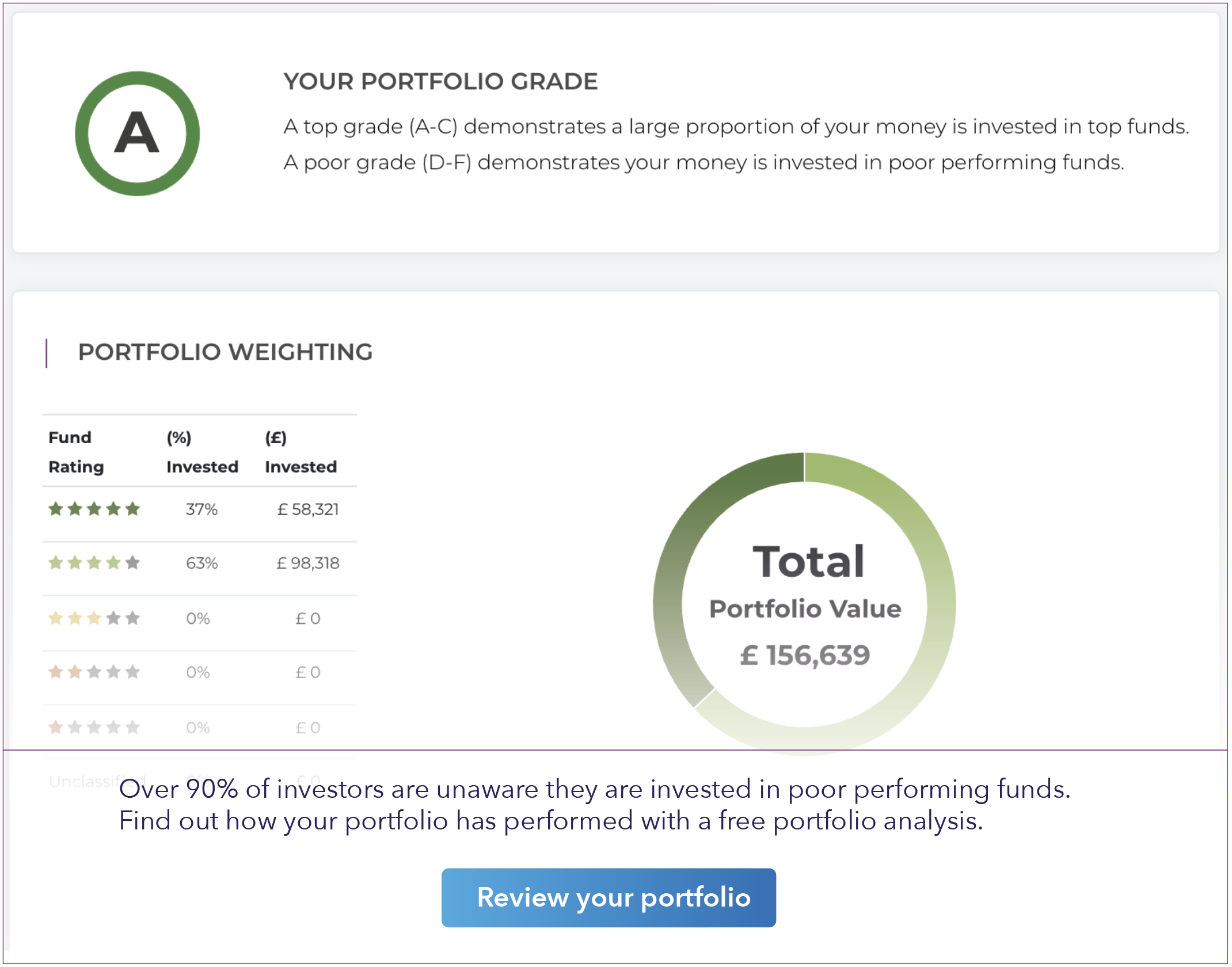

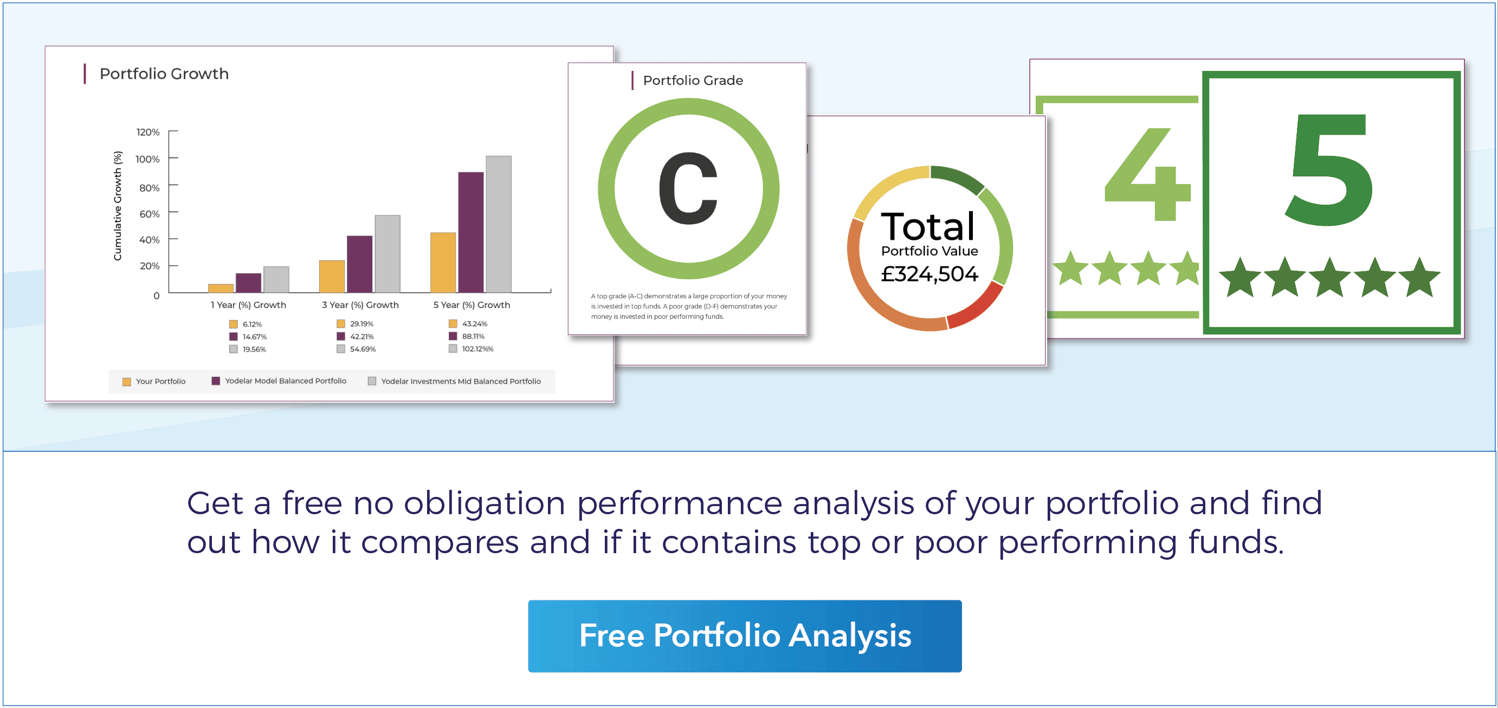

Yodelar analyses thousands of UK investment portfolios each year, and these analyses regularly identify that over 90% of portfolios contain funds with a history of poor performance, which reflects the high percentage of poor-performing fund choices on the market as well as a lack of knowledge among investors and advisers as to which investment funds and fund managers make up the small proportion of top performers.

To help investors identify the funds and fund managers that have a history of outperformance in their sectors, we have produced a condensed PDF download featuring the funds that have consistently outperformed three-quarters of all other funds classified within the same sectors over the past 1, 3 & 5 years.

Download the full best funds report

Top Performing Funds

There are 50 different investment sectors listed by the industry trade body the investment association, each containing a portion of funds that have the same objectives and follow similar strategies.

Some of these sectors are quite niche and hold only a small number of funds whereas other sectors are more prominent and hold hundreds of funds.

Investment sectors are key to analysing the performance of investment funds as to gain a representative performance analysis of each fund they can only be analysed alongside other funds within the sector in which they are classified.

The reason for this is because each fund has its own strategy and objectives which are defined by the composition of stocks in which the fund invests in. For example, a fund that wants to target the UK market will invest primarily in companies based in or conduct the majority of their operations in the UK. Similarly, a fund with the objective of targeting the US market will invest primarily in companies based in or conduct the majority of their operations in America. How each of these funds performs is connected to the market in which they invest, and as a result, any like for like comparison between the two is not possible.

But by having sector classifications, it enables funds with similar compositions and objectives to be categorised together making a like for like performance comparison possible.

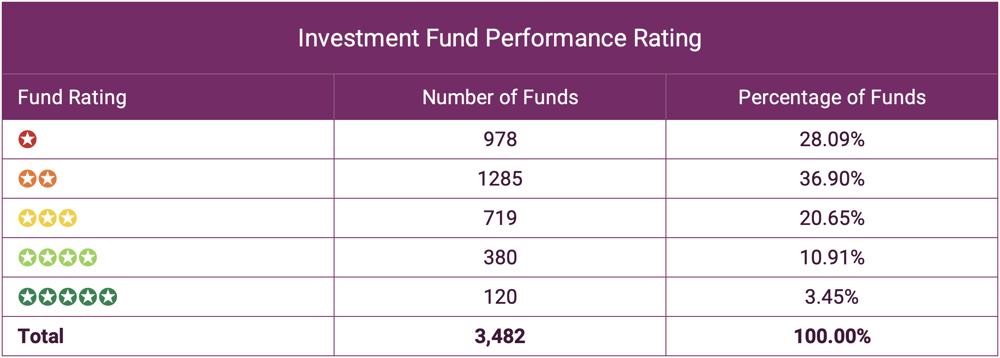

In order to identify the best performing funds, we compared each of the 3,482 funds for performance over the past 1, 3 & 5 years alongside all other funds within their respective sectors.

Our analysis of these funds identified that 65% received a poor performing 1 or 2-star rating with less than 14% gaining a top 4 or 5-star performance rating.

How Yodelar Rate Funds

How we rate fund performance is completely transparent and based on the quartile ranking of each fund within their classified sector over a 1, 3 and 5 year period. See table below.

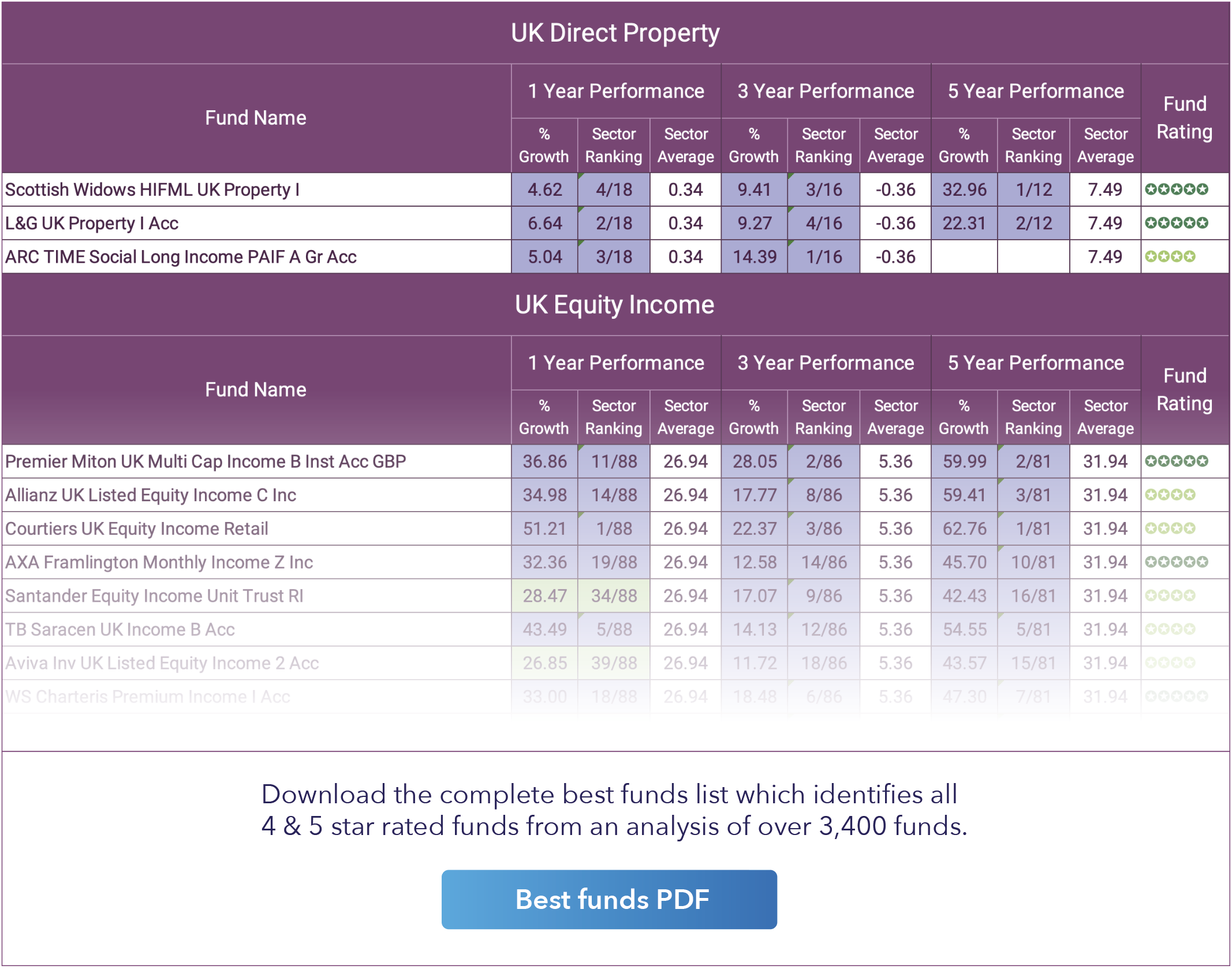

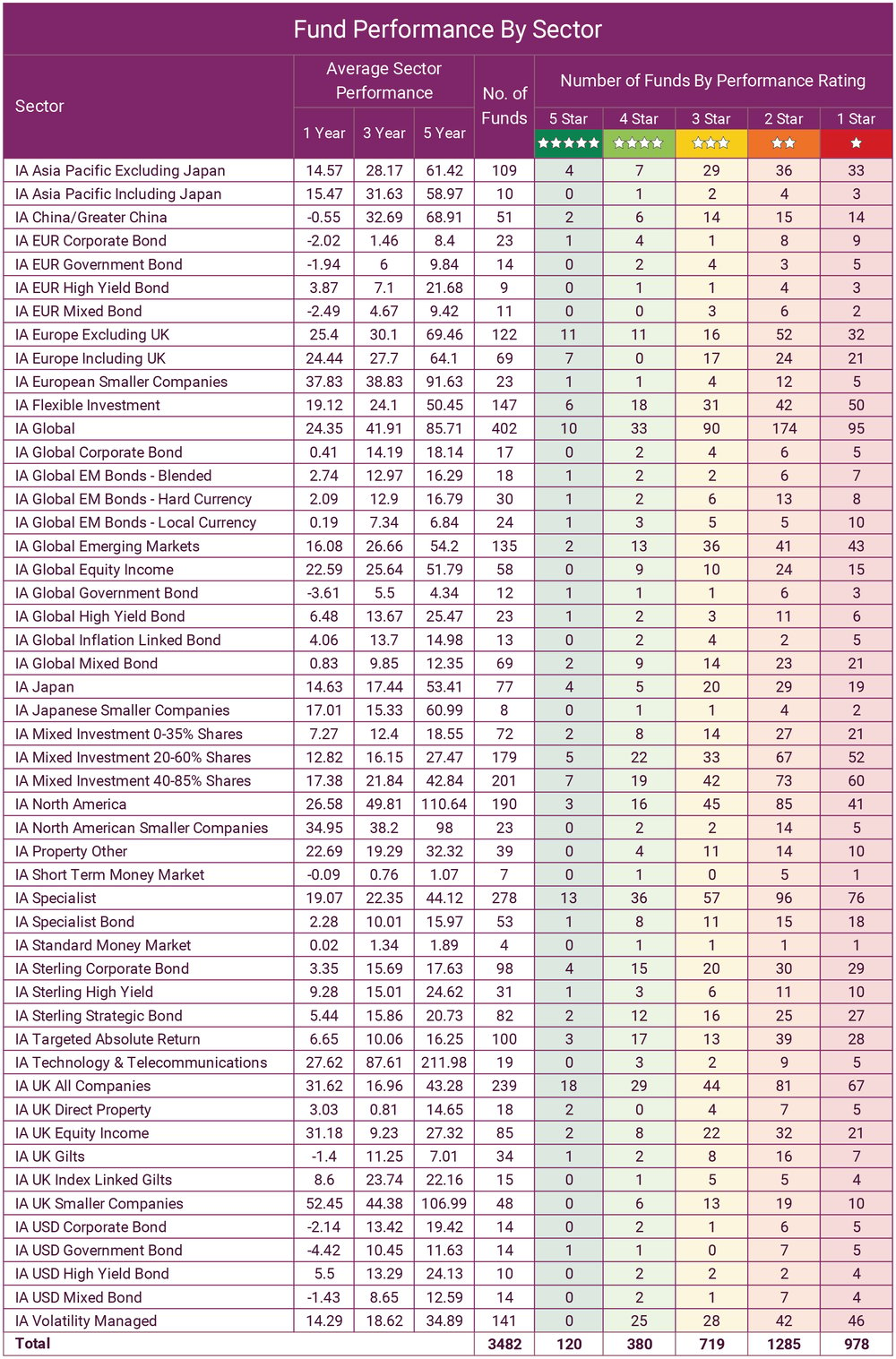

In total, there is over £1.5 trillion of investor money held in the 3,482 funds that were analysed for this report. These funds are spread across 50 different sectors that have been classified by industry trade body the Investment Association. The table below identifies the average performance of funds within each sector over the past 1, 3 & 5 years and features the rating of each fund with each sector.

5 of the most popular region-specific sectors, which are home to some of the most widely used funds on the market, are the UK All Companies sector (UK Equities), North America sector (North American Equities), Europe ex UK sector (European Equities), the Emerging Markets sector (Emerging Market Equities) and the Global investment sector (Global Equities - funds that are invested in companies across several different regions).

Over 35% (£525 billion) of the total money held in all 3,482 funds on the market are currently held in funds within these 5 sectors.

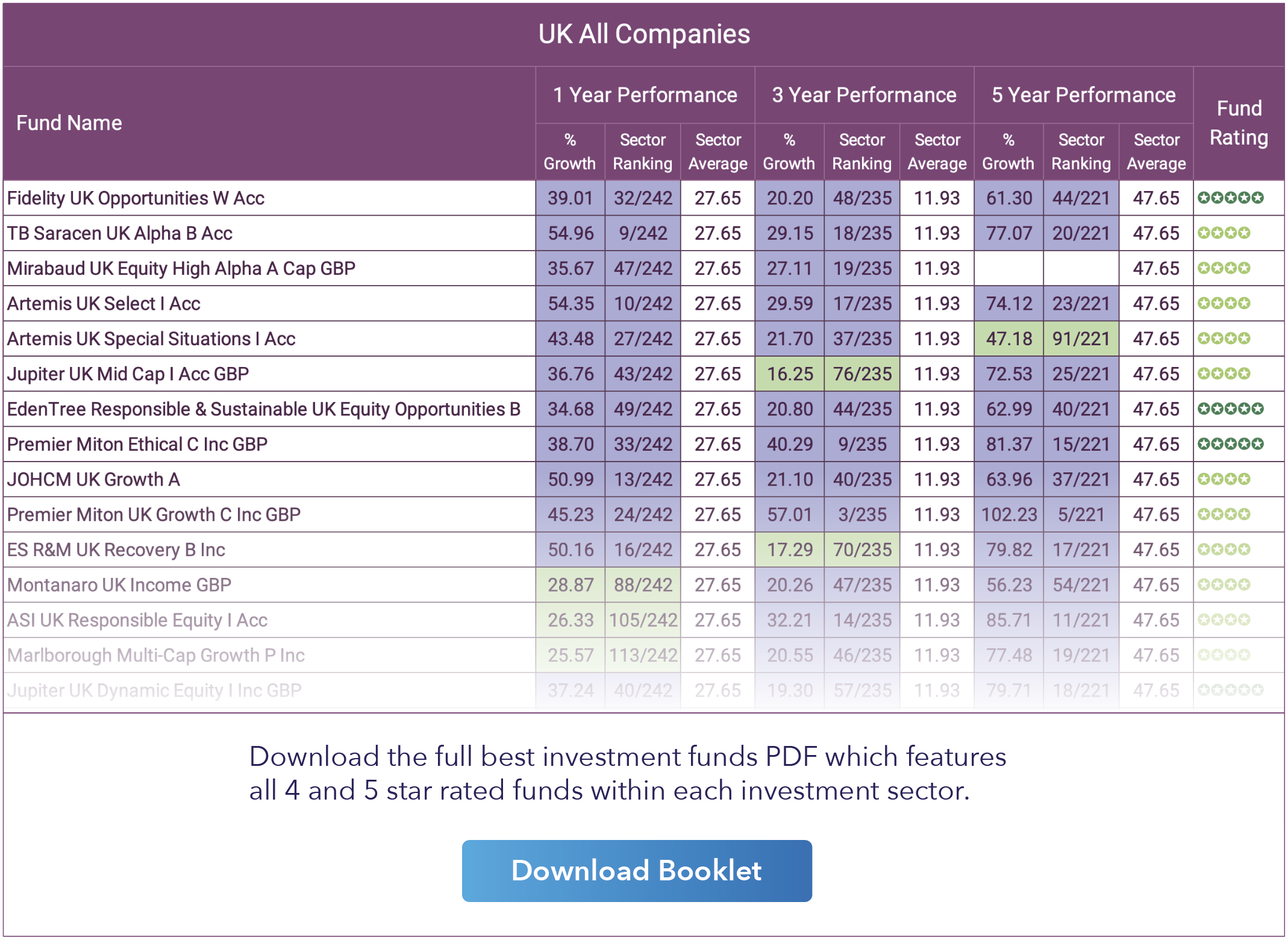

Best UK Equity funds

The UK is home to some of the most successful companies in the world, and as many are globally diversified, they can absorb many of the UK’s political and economic changes.

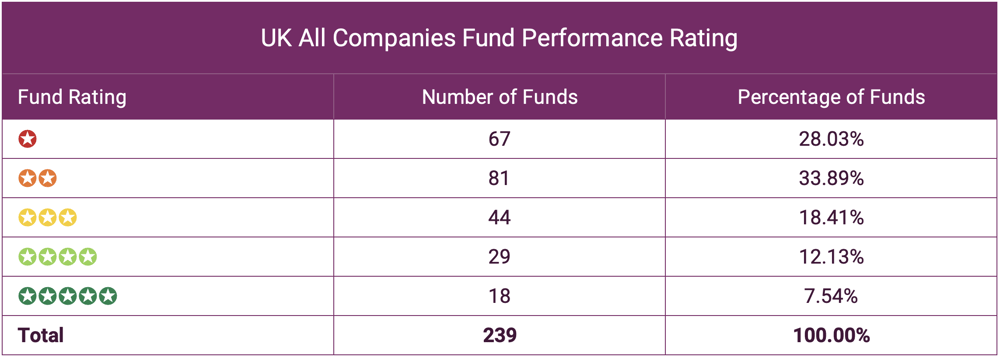

Despite huge outflows from UK equity funds over the past few years, primarily as a result of Brexit, the UK Equity market remains an important sector for investors to maintain a balanced portfolio. The main sector that represents UK Equities is the UK All Companies sector which is home to 239 funds with a total of £165 billion of investor money under management.

We compared each of these 239 funds for performance over the past 1, 3 & 5 years and identified 47 (19.67%) had received a 4 or 5-star performance rating.

These 41 funds are listed in the full PDF Best investment funds report.

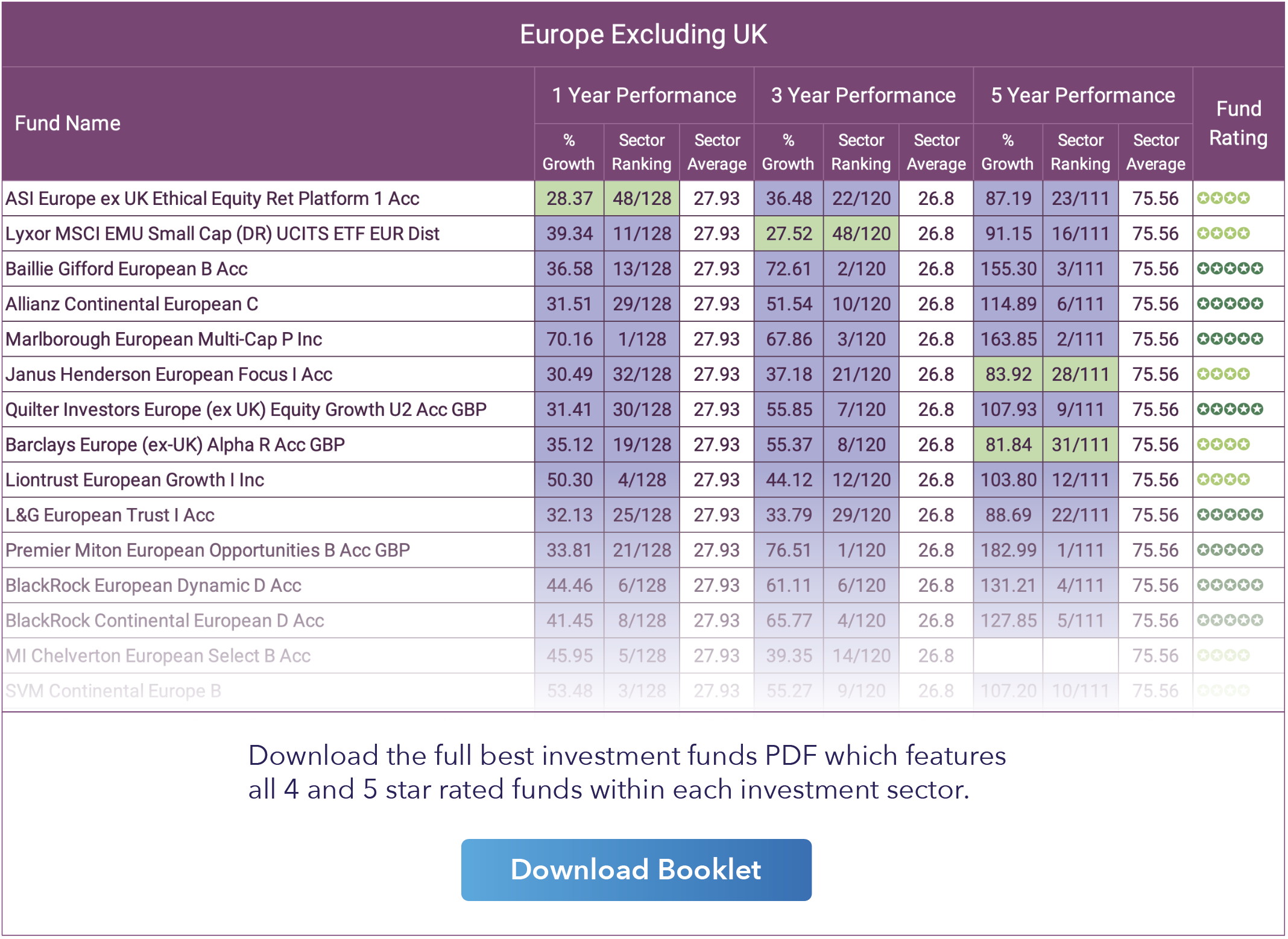

Best European Funds

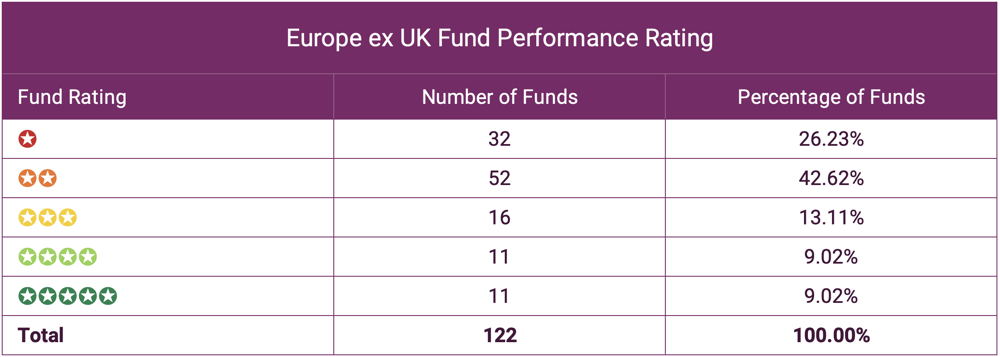

Europe is more than just a single continent. It’s politically, economically and culturally diverse. There are around 50 countries in Europe and 28 EU member states, so this sector remit can be quite wide. Funds may invest in companies of all sizes within these diverse economies. To classify within the IA Europe ex UK sector a fund must invest at least 80% of their assets in European equities and exclude UK securities. But up to a maximum of 5% of the total assets of the fund can be invested in UK equities to allow flexibility for corporate actions.

Our analysis of the 122 funds classified within the IA Europe ex UK sector identified that 18.04% received a 4 or 5-star performance rating. Each of these funds is listed in the best funds PDF which can be downloaded for free below.

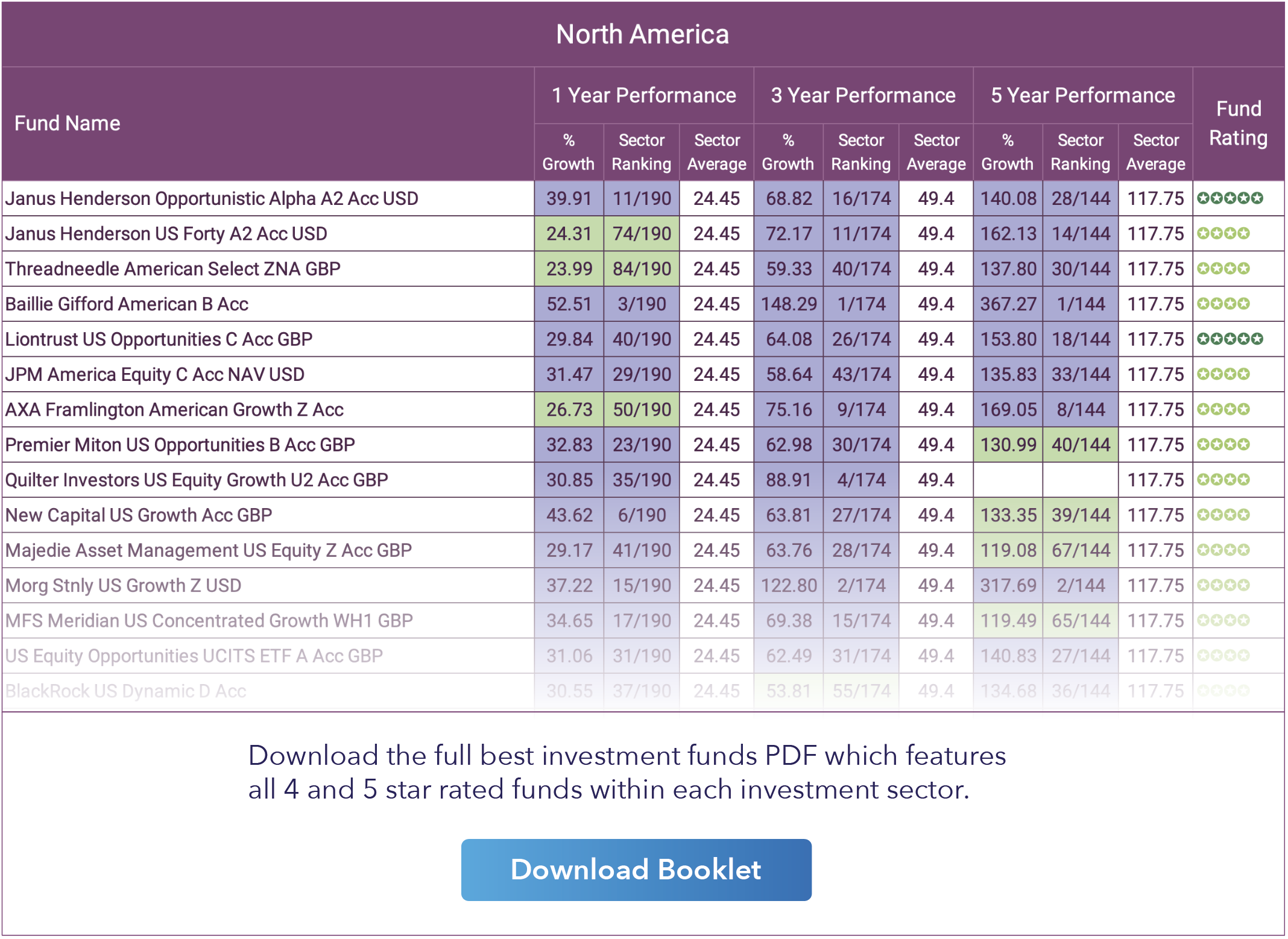

Best North American Funds

The North American equity sector is an important asset class that is likely to form an integral part of many mid to higher risk investment portfolios. North American equities have consistently been among the most competitive and volatile asset classes, but in recent years, it has also been one of the most rewarding for investors with the funds within this sector averaging growth of 110.64% over the past 5 years, which is the 2nd highest growth average across all 50 sectors, with the Technology & Telecommunications sector the only one to average higher returns.

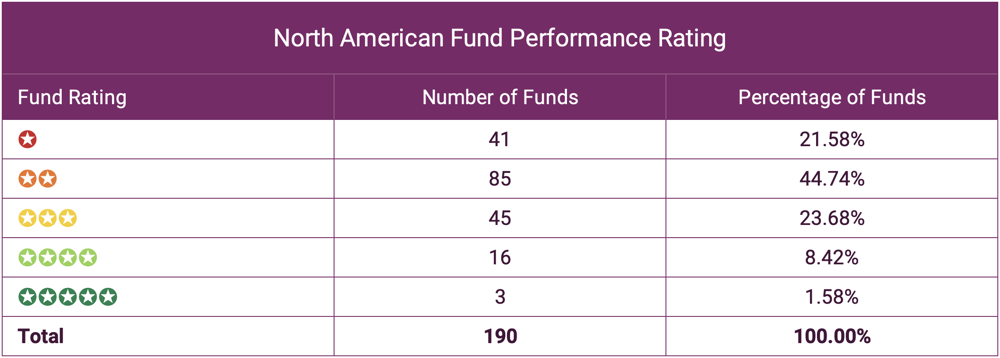

Selecting the most suitable funds in this asset class for your portfolio can be difficult for both investors and advisers, but the performance of the funds within these sectors can vary significantly and as identified in the table below, just 10% of the funds in this sector managed to gain a 4 or 5-star performance rating, with 66% of the funds in this sector consistently underperforming.

Best Emerging Market Funds

Emerging market assets remain higher-risk and volatile assets, and they should only be held as part of a widely diversified portfolio, which includes exposure to other parts of the world. But in recent years, emerging markets have become more diverse and less dangerous than their reputation can imply, with the top performers delivering exceptionally strong gains.

Despite the increased volatility of this past year, emerging markets have continued to perform well for investors, and while it's impossible to predict the future, the top-performing Emerging market funds have continued to navigate through choppy waters to deliver consistent top performance for their investors.

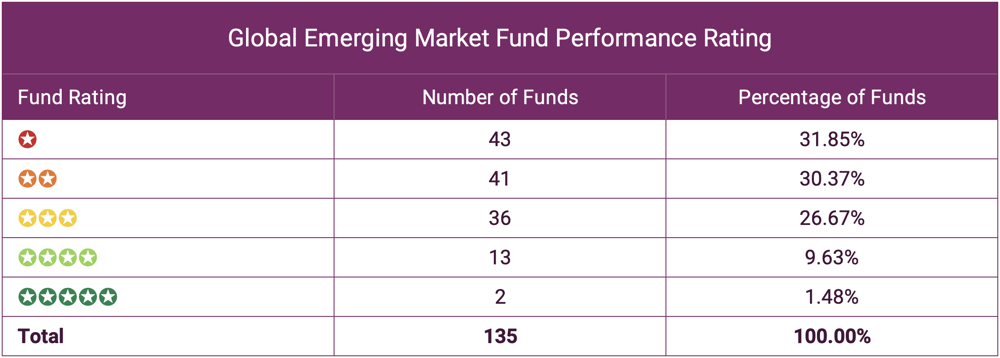

In total, 11.11% of the funds in the Global Emerging Markets sector received a 4 or 5-star performance rating. Download the full PDF to see all 4 and 5 star rated funds.

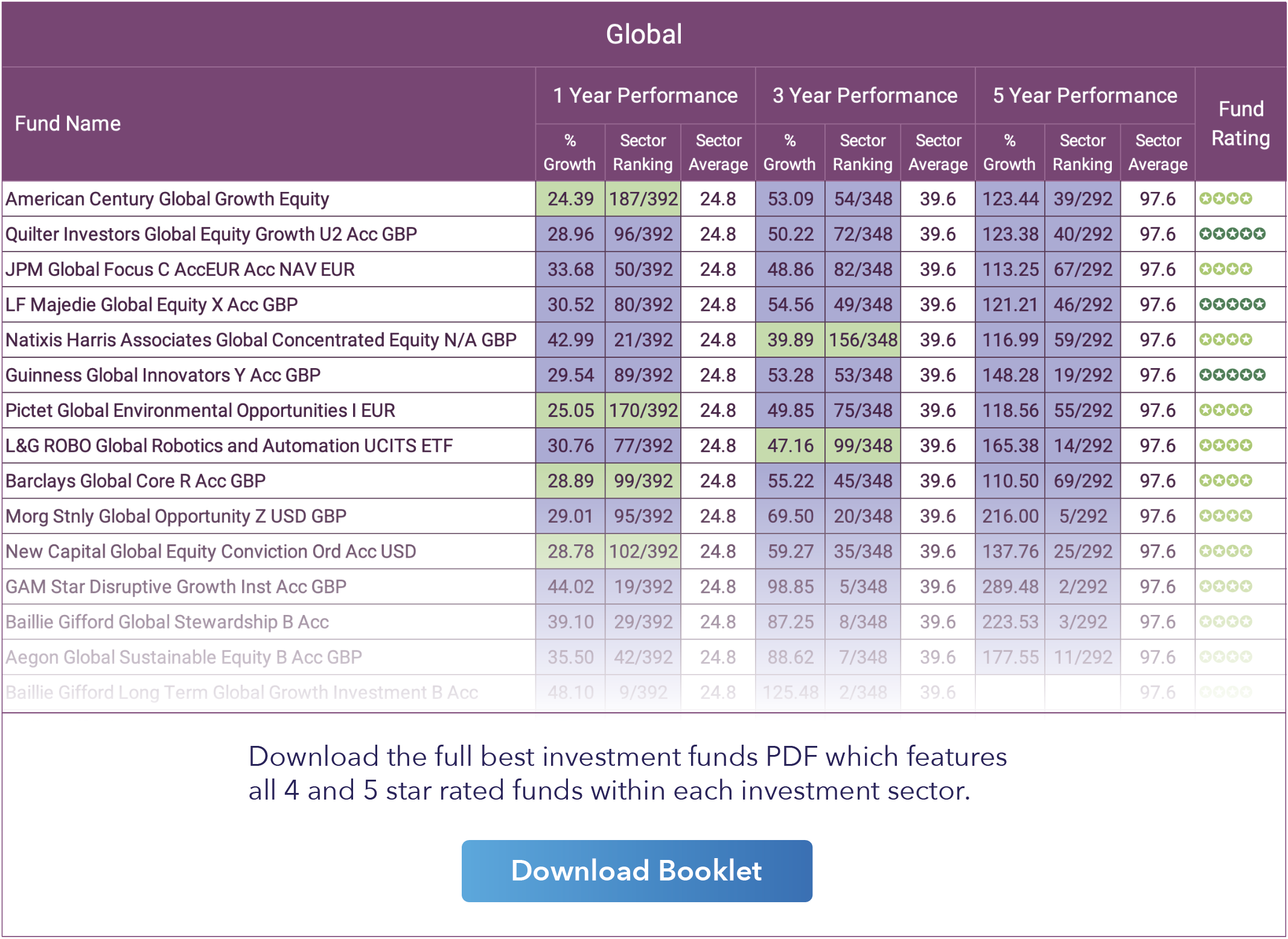

Best Global Funds

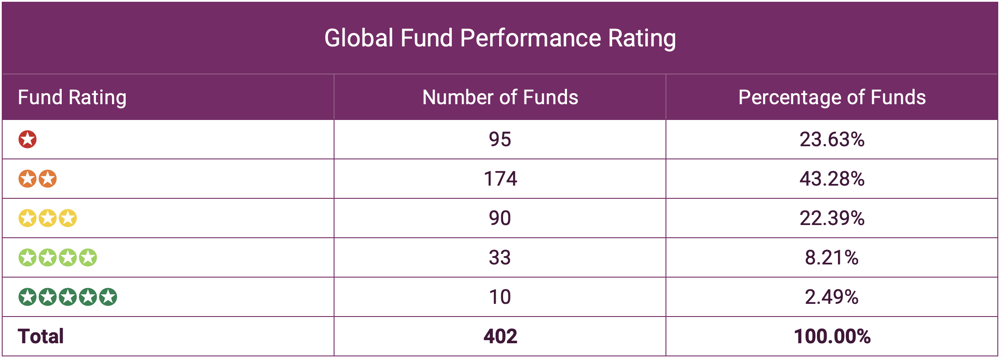

The largest of the 50 sectors analysed was the Global sector with some 402 funds classified within this sector managing a combined total of £180 billion. It is home to some of the most recognisable funds on the market with the Fundsmith Equity fund and Lindsell Train Global Equity funds among the funds classified within this sector.

Global funds invest in a wide range of stocks across world markets, with this broad focus potentially helping to minimise the impact of stock market shocks on a portfolio. For example, if one region or sector suffers a knock, hopefully gains elsewhere will help offset these losses.

However, in recent times, a large proportion of growth enjoyed by Global funds can be attributed to their heavy weighting in US stocks, with North American equities averaging some of the highest returns across all asset classes. These funds do not qualify for the North American sector as the proportion of stocks they hold does not fit the sector's threshold.

What classifies a Global fund?

The investment association's criteria for a Global fund is a fund that invests at least 80% of its assets globally in equities and is diversified by geographic region.

Specific sector notes:

- The main focus of funds that elect to be classified to this sector should be geographic diversification.

- Funds that qualify for the UK, regional or the Global Emerging Markets equity sector will be excluded.

- Funds may elect to be classified to the Global sector on the basis of geographic diversification even where a style or thematic bias exists - for example, Global Consumer funds, Global Climate Change funds, Global Income funds, Global Smaller Companies funds.

- Global funds which focus solely on a single industry sector may also elect to be classified to the Global sector, subject to maintaining geographic diversification - for example, all types of Global Commodity funds (Agriculture/ Resources/Gold), Global Financials, Global Pharmaceuticals fund.

As the most popular sector with the highest number of funds, not surprisingly the Global sector has the largest number of consistently top performing funds, with a total of 43 funds with a 4 or 5-star performance rating.

With a 5 year average growth of 85.71%, the Global sector has the 6th highest average return of all 50 sectors but as the funds in this sector are more diversified they are often a more popular choice with investors. In the PDF list of all best funds, we feature all 43 best performing funds in the Global sector.

The Importance of Fund Performance

Fund performance is a critical metric that efficient investors and high-quality advice firms analyse to help ensure their portfolios productively meet objectives while utilising fund managers that have demonstrated consistency in delivering efficient returns.

Past performance is not an indicator of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform well over varying time frames. This report highlights the various fund managers that have consistently performed better than 75% of same sector funds managers.

Comparative Performance

Each fund’s performance can be compared to all competing funds that are classified within the same sector. How each fund ranks over multiple time frames can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability

Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise, whereas fund managers whose funds continually rank lowly within their sector have demonstrated a lack of quality and an inability to deliver competitive returns for investors. Past performance is not an indicator of future returns, but it is important information that holds fund managers accountable for their performance.

Consistency

A cycle of 1, 3 & 5-years exposes investments to different economic and political challenges. How a fund and fund manager performs over multiple cycles reflects on their capabilities and overall quality.

The Best ISA Funds

All 3,482 sector funds analysed for the best funds list are eligible for inclusion in an ISA and the best funds PDF features the 500 funds that have consistently outperformed their sector peers over the last 1, 3 & 5 years making them some of the most attractive investment options for an ISA.

Although future performance is never guaranteed it is reasonable to assume the funds which have proven their consistency over a 5-year period, will continue to outperform their peers in the future. These individual fund managers demonstrate consistency in their ability to do their job well.

Selecting funds that consistently perform better than their peers and fit within a suitable asset allocation model will help investors to maximise their portfolio growth potential.

If using a financial adviser to build and manage your ISA, make sure that you are partnered with someone that has performance knowledge and who can demonstrate that easily. As fund performance is not a regulated requirement of financial planning, financial advisers are not required to research the performance of funds. As a result, a large proportion of advisers have a poor level of knowledge in relation to fund performance.

As no single equity style, sector, country or region outperforms all others all of the time. Global diversification spreads risk amongst countries and currencies to offset the risk of investing in just one region or country. As such, having a globally diversified ISA portfolio is vital to long-term investment success.

It’s nearly impossible to pick and choose which asset classes will be top performers at any given time. While one particular market may outperform others one year that doesn’t mean it will continue to do better than others over the long term.

Nobody knows with any degree of certainty what asset classes and global markets will be the best performers next year. Therefore, the most efficient way for investors to capture the returns of the markets is to invest with diversity and spread their portfolios assets.

By ensuring your portfolio contains only consistently top-performing funds, within an asset allocation model suitable to your risk profile, you have covered the 2 main aspects of maintaining an efficient portfolio.

The funds featured in the best funds PDF and the diversification of each sector provides the basis for investors to identify and construct a suitably diversified portfolio of top performing funds for their ISA.

Our research has identified that the majority of investors are missing out on extra portfolio growth due to subpar fund choices and general inefficiencies in their ISA portfolio. Inefficient investing will undoubtedly have adverse long-term consequences, which is why it is so important to be able to identify and correct any portfolio deficiencies. Find out if your ISA portfolio contains top or poor performing funds with our industry-leading portfolio analysis service.

The Best Pension Funds

Over the past several years as auto-enrolment came into effect there has been a huge increase in the number of pensions in the UK - between 2012 and 2019, the number of employees with workplace pensions rose by 82.5%.

In 2019, just over 21 million employees in the UK had a workplace pension with most of these enrolled in an occupational scheme. Research from The Pensions Regulator shows that more than 95% of workers stay in their pension scheme’s default fund for convenience but often these default funds have low returns when compared to a diversified portfolio of high-quality funds.

Many pension investors are unaware of the wide-ranging options they have for their pensions, and limit their investments to a selection of pension schemes put in place by large pension providers. However, many of the funds featured in the best funds list are accessible for pension investors and as part of a suitably diversified, risk-rated portfolio they can help investors achieve significantly better pension returns.

Based on the asset allocation model, that best fits your objectives investors have a wide range of high quality options to choose from when investing for their pension. In the best funds PDF there are significant high quality funds across numerous sectors and asset classes that can provide the foundation for constructing excellent pension portfolios.

Summary

From the 3,482 sector classified unit trust funds available to UK investors 14.4% have a history of consistent top performance - this is up from 13.6% at the end of the last quarter.

Investing is the balance of risk and quality. There are numerous asset allocation models and investment strategies to suit each investor but there is only a limited selection of funds available that have a proven history of exceptional quality.

The investment market is littered with poor products, and the limited information available relating to performance has made it difficult to identify the good from the bad. This has resulted in billions being placed in funds that have persistently underperformed causing many investors to miss out on growth with their investment, ISA and pension portfolios.

The funds featured in the best funds list have consistently been the best performing funds in the UK over the past 1, 3 & 5 years. They have proven their quality and as part of a diversified portfolio they can continue to offer excellent investment opportunities for investors.

Best Investment Portfolios

Diversification and asset allocation is intrinsically linked with risk and as such, it is the single most important aspect of investing and critical to the success of a long-term investment strategy. A common error we witness among self managed investors in particular is the desire to pick out and only invest in the funds that have delivered the highest growth returns, often it is a very small range of sectors that have the highest growth averages.

However, investment fund performance can only be compared to other funds within the same sectors, and by only selecting the best funds from the highest growth sectors, investment portfolios will lack diversity and assume very high degrees of risk. As a consequence, should that sector experience a period of turbulence it would result in the entire portfolio falling in value as opposed to only a designated portion if the portfolio was strategically balanced across several different sectors/markets.

Investing is the balance of risk and quality. There are numerous asset allocation models and investment strategies to suit each investor but there is only a limited selection of funds available that have a proven history of exceptional quality.

Download our most recent and complete list of best performing funds to see the 500 funds from an analysis of 3,482 that have consistently outperformed their sectors.

Join over 40,000 investors and get a free, no-obligation performance analysis of your investment funds and overall investment portfolio.