- This report evaluates the performance of 63 investment brands, with each assessed and ranked based on the performance of their funds in 2024.

- Fund manager Artemis ranked 1st with 86.9% of their funds performing in the top half of their sectors for performance over the past year. Artemis, also ranked 1st in our main league table as well, with the highest proportion of 4 & 5 star funds under their management.

- Based on fund performance in 2024, EdenTree ranked last place among the 63 fund managers analysed with 61.5% of their funds classifying in the bottom 25% of their sector for performance.

In 2024, investors faced a mix of growth opportunities and challenges as stabilising markets, sector-specific gains, and volatility shaped the landscape. While top fund managers capitalised on these conditions to deliver strong results, some fund management brands struggled to provide competitive returns across their funds.

In this report, we identify the best and worst fund managers based on how their funds performed over the past year. We analysed the performance of 63 fund management brands and 2,350 sector-classified funds and rank each in order of performance.

Top Performing Fund Managers in 2024

For this report we analysed 63 fund management brands and 2,350 sector classified funds for performance in 2024. Each fund manager was ranked based on what proportion of their funds ranked in the top two quartiles of their sectors for performance, minus the percentage of that ranked in the third and bottom quartiles.

Each of the fund managers, manage at least 10 funds, with iShares from BlackRock, responsible for the most funds at 188.

The standout performer of 2024 was Artemis, with an impressive 20 out of 23 funds ranking in the top half of their sectors. This exceptional result secured Artemis the top position in our 2024 rankings and was further reinforced by their first-place standing in our five-year Fund Manager League Table, which evaluates performance over 1, 3, and 5-year periods.

In contrast, EdenTree Investment Management ranked at the bottom, with 84.6% of their funds placed in the bottom half of their sectors for performance over the past year. A key factor behind this underperformance is the firm's stringent ethical and sustainable investment criteria, which limited exposure to higher-growth markets and sectors that fell outside their ethical mandate.

Best & Worst Performing Fund Managers of 2024

Below, we highlight five of the most prominent UK fund managers, examining their performance in 2024. While some secured top positions through exceptional results, others faced challenges in delivering competitive returns and ranked lower in the table.

Artemis 2024 Fund Performance

Artemis earned the top position in this year’s fund manager rankings, reflecting its exceptional results. The firm manages 23 sector-classified funds, with an impressive 15 funds (65.2%) ranking in the top quartile and 5 funds (21.7%) in the second quartile. This outstanding performance highlights Artemis’s leadership in its sector and dedication to delivering value to its clients.

Artemis is widely recognised by investment experts as a top-tier fund management firm in the UK. Founded in 1997, the firm oversees approximately £26.7 billion in assets as of November 2024, showcasing its significant role in the investment industry.

Artemis offers a diverse range of funds, investing across the UK, Europe, the US, and global markets. Known for its independent ownership structure, shared between its UK-based management team and the Affiliated Managers Group (AMG), Artemis fosters a culture of collaboration and accountability that underpins its ongoing success.

At the core of Artemis’s philosophy is a commitment to active investment management. Unlike firms bound by rigid frameworks, Artemis gives its fund managers the freedom to implement their own strategies. This approach, combined with the distinctive practice of managers investing their own money into the funds they oversee, ensures a strong alignment with client interests and reinforces their focus on delivering superior results.

Beyond excelling in this year’s rankings, Artemis also secured the 1st position in our fund manager league table, which evaluates performance over the past 1, 3, and 5-year periods. This achievement showcases not only their short-term success but also their sustained excellence in fund management.

St. James’s Place 2024 Fund Performance

Our analysis also includes St. James’s Place (SJP), a fund management giant established in 1991 and one of the UK’s largest wealth management firms, overseeing £184 billion in assets. Despite its size and ongoing investment in growth, SJP has faced persistent criticism for the underperformance of its funds and reliance on restricted investment products. Coupled with a widely criticised charging model, often deemed among the most expensive in the industry, the firm's value proposition continues to be a subject of debate.

In our best fund managers of 2024 table, SJP classified in the bottom half for the performance of their 36 unit trust and OEIC funds with a ranking of 38 out of 63 fund managers. Nearly half (47.2%) of their funds underperformed, with 12 ranked in the third quartile and 5 falling into the bottom quartile.

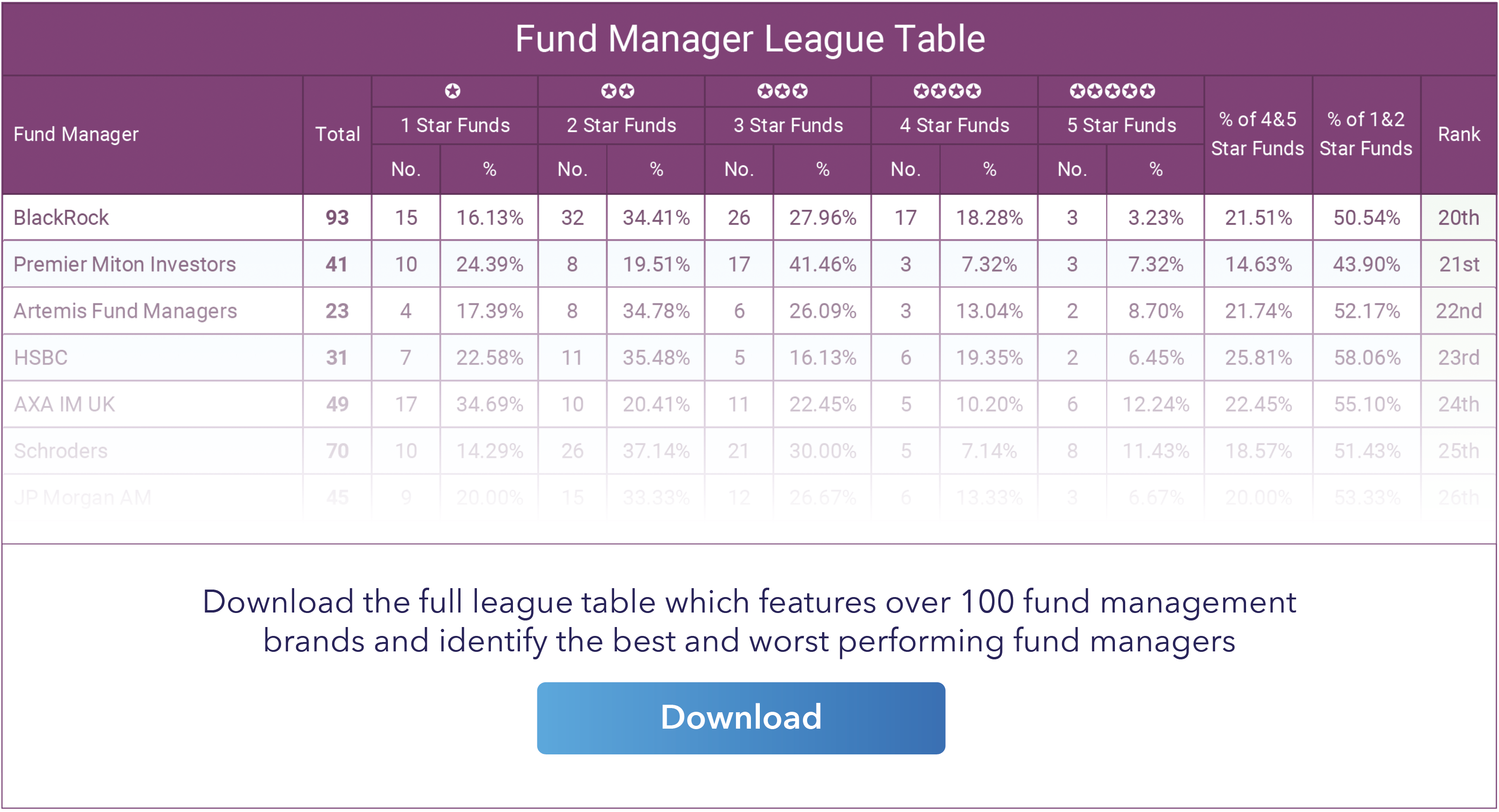

Our Fund Manager League Table - which ranks fund managers based on the 1, 3 & 5 year performance of their funds - St. James's Place feature in the bottom 15%, with 25 of their 36 funds receiving a poor 1 or 2 star rating.

Baillie Gifford 2024 Fund Performance

Baillie Gifford is highly regarded by investment professionals as one of the best fund management firms in the UK. Founded in 1908, it has grown to become the largest independent active investment management firm in the country, managing assets worth £225 billion. Known for its growth-focused strategies, Baillie Gifford targets companies with long-term potential, particularly in innovative sectors like technology, healthcare, and renewable energy.

Unlike most large-scale investment firms that rely on mergers and acquisitions to drive growth, Baillie Gifford has remained completely independent as a private partnership. This independence is key to its success, fostering a culture based on partnership, rigorous research, and an unwavering focus on long-term growth. Baillie Gifford has always been a strong advocate of active fund management, which it refers to as ‘Actual’ investing, believing that “anything less is not investing.”

The firm faced significant challenges following the market crash at the end of 2021, with many of its funds experiencing substantial underperformance. However, by October 2023, as market conditions began to stabilise, the firm started to recover notably. In 2024, 18 out of their 30 funds were ranked in the top half of their respective sectors, indicating improved performance. This recovery earned Baillie Gifford the 27th position in the 2024 performance table.

An example is the Baillie Gifford American fund, which achieved a growth of 48.25% over the past year. This impressive performance placed it 7th among 232 funds in the highly competitive IA North America sector, where the average growth for the year was 31.17%.

Nonetheless, its 71st place in the main league table highlights the ongoing impact of previous difficulties.

However, Baillie Gifford remains steadfast in its dedication to long-term investing, maintaining confidence in its ability to deliver substantial returns over time.

Edentree Investment Management 2024 Fund Performance

EdenTree Investment Management, established in 1988, is a UK-based firm specialising in responsible and sustainable investing. Operating as a subsidiary of Ecclesiastical Insurance Group and wholly owned by the Benefact Group, EdenTree manages approximately £3.5 billion in assets.

Its investment philosophy emphasises active management and long-term value creation, focusing on companies that adhere to ESG standards. Despite this commitment, EdenTree ranked last among 63 fund managers in the 2024 Fund Manager Performance Table.

Our analysis of the 13 funds found that 11 consistently underperform, with most placed in the bottom quartile of their respective sectors. This persistent underperformance has called into question the effectiveness of its strategies in delivering meaningful financial returns.

In our main, more in-depth Fund Manager League Table, EdenTree ranked 60th out of 77 fund managers for 1, 3 & 5 year fund performance. Whilst this represents a low rating, other more recognisable fund managers such as Hargreaves Lansdown, St. James's Place, Baillie Gifford and 7IM ranked below them.

JP. Morgan 2024 Fund Performance

J.P. Morgan Asset Management, founded in 1865, is one of the oldest and most respected asset management firms globally. With $3.3 trillion in assets under management worldwide and £195 billion in the UK alone, the firm holds a significant presence and influence in both British and international financial markets.

J.P. Morgan continues to rank among the best fund managers, securing 6th place in both the 2024 Performance Table and our Main Fund Manager League Table. Their funds delivered strong results, with 18 funds (40.9%) achieving top quartile rankings and 15 funds (34.1%) in the second quartile out of 44 sector-classified funds. These outcomes demonstrate the firm's focus on maintaining performance consistency.

Importance of Evaluating Fund & Fund Manager Performance

Assessing the performance of fund managers and their investment funds is a critical practice for both individual investors and reputable financial advisory firms. Understanding how your chosen funds are performing can help determine whether you are entrusting your money to fund managers who consistently deliver competitive returns. Although past performance does not guarantee future results, studies indicate that fund managers who have regularly outperformed their peers over various periods are more likely to continue doing so than those with a record of underperformance.

Key Benefits of Analysing Fund & Fund Manager Performance

Analysing the performance of a fund can offer several insights that are crucial for making sound investment decisions. Here are four key benefits:

1. Insights from Past Performance

While past performance is not a definitive predictor of future success, it remains a valuable indicator for many investors. When deciding where to invest, most investors prefer fund managers who have consistently ranked in the top 25% of their sectors over those who have been in the bottom 25%. This historical data can offer insights into the reliability and strategy of a fund manager.

2. Comparative Analysis of Funds

Comparing the performance of a fund with other competing funds within the same sector can help gauge its relative strength. Such comparative analysis over medium to long-term periods can reveal the quality of the fund and the expertise of its manager. Understanding how a fund measures up against its peers can assist investors in identifying funds that are more likely to align with their financial goals.

3. Accountability of Fund Managers

Past performance is a powerful tool for holding fund managers accountable. Funds that consistently perform well within their sectors often reflect a high level of expertise from their managers. Conversely, fund managers whose funds regularly rank poorly within their sector may indicate a lack of quality management and an inability to deliver competitive returns. Evaluating performance enables investors to choose fund managers who demonstrate effective strategies and management skills.

4. Consistent Performance Through Market Cycles

Over a period of five years, funds and their managers face various economic and political challenges. The ability of a fund manager to navigate these cycles and deliver stable or superior returns is a testament to their expertise and overall competence. Funds with a strong performance history across different market conditions are more likely to inspire confidence among investors looking for reliable long-term investment options.

How Efficient Is Your Portfolio?

Inefficient investing will undoubtedly have adverse long-term consequences. It is important to identify and correct any portfolio deficiencies.

For years, Yodelar has analysed the performance and quality rating of portfolios for thousands of UK investors. Our extensive analysis has uncovered that over 90% of investors hold portfolios containing inefficiencies that stunt growth potential, resulting in many UK investors to miss out on enhanced portfolio growth.

Our industry leading portfolio analysis service enables investors to find out how their portfolio compares to a similar risk-profile portfolio constructed with top-performing funds. This unique tool provides measurable ratings that offer complete transparency into the quality of individual fund choices and the overall portfolio's competitiveness.

By utilising our portfolio review feature, investors gain detailed insights into the performance of their investments and can determine whether their current approach is optimally positioned for growth.

Key Benefits Include:

- Assess the performance of each fund

- See where each fund ranks within its sector over 1, 3, and 5 years

- Find out each fund's performance rating between 1 to 5 stars

- Identify the proportion allocated to top, mediocre, or underperforming funds

- Compare portfolio growth against model portfolios built with consistently top-performing funds

- Receive an overall portfolio performance grade from A to F