-

Artemis ranked 1st in our 2024 fund manager rankings and also topped the Fund Manager League Table for the 1, 3 and 5 year performance of their funds.

-

Of the 24 funds analysed, 13 earned top 4 or 5-star ratings over the past 1, 3, and 5 years.

-

20.8% of Artemis funds have underperformed, with 5 funds receiving a low 1 or 2-star rating.

-

54.2% of their funds have consistently outperformed competing funds within the same sector and received a top performing 4 & 5 star rating.

Artemis has established itself as one of the UK's most successful fund managers, with many of its funds delivering strong returns over different time periods. Our analysis of their 24 funds over the recent 1, 3, and 5 years identifies that more than half have outperformed their sector peers.

In this article, we identify their best performing funds and provide access to the full downloadable Artemis performance report, which identifies the performance, ranking and rating of all Artemis funds.

Artemis Funds Performance

For this report, we completed a detailed review of 24 Artemis funds, assessing their performance and sector rankings over 1, 3, and 5 years. Each fund was evaluated and given an overall rating based on its returns compared to sector peers.

Our analysis shows that most Artemis funds have performed well. 13 funds (54.2%) received a high rating of 4 or 5 stars, reflecting robust and competitive performance.

In contrast, 5 funds received the lowest ratings of 1 or 2 stars, indicating that a comparatively small proportion underperformed within their sectors.

These findings highlight that more than half of Artemis funds have delivered consistently strong returns, reinforcing their top ranking within our fund manager league table.

Top performing Artemis Funds

The 5 funds below have consistently been among the top-performing Artemis funds in their respective sectors over the past 1, 3 & 5 year periods analysed.

These funds were awarded a top 4 or 5-star rating based on their performance compared to the sector peers.

Sector Fund Charges Comparison

As well as excelling within their sectors, the 5 top performing Artemis funds featured in the above table have also annual charges that are lower than the majority of funds within their respective sectors.

The table below provides an overview of sector average fund charges across the five featured funds Investment Association (IA) sectors.

Artemis Short-Dated Global High Yield Bond Fund

Launched on 20 June 2019, the Artemis Short-Dated Global High Yield Bond Fund has established itself as one of Artemis’ strongest performers. Its goal is to outperform its benchmark over three years by combining income generation with capital growth.

The fund invests in high-yield bonds that are close to maturity, typically with a duration of 0–2 years. This short timeframe means investors receive their capital back sooner, reducing the impact of interest rate fluctuations compared to longer-duration high-yield funds. It follows a global approach without being tied to an index, allowing the managers to focus on the most attractive opportunities across different markets and currencies.

With £161.8 million in assets under management, the fund has consistently delivered stronger returns than its peers in the IA Sterling High Yield sector. Over the past year, it returned 12.60%, ahead of the sector average of 8.76%. Its three-year growth reached 27.62%, nearly three times the sector’s 9.73%, making it the top performer among 27 funds in its category. Over five years, it returned 30.82%, well above the sector’s 19.04%.

Its success comes from capturing high yields while managing risk effectively. The fund also integrates Environmental, Social, and Governance (ESG) considerations into its investment decisions, aligning with a long-term, sustainable approach.

With an ongoing charge of just 0.31%, it offers a cost-effective way to access high-yield opportunities while maintaining lower volatility than many of its peers.

Artemis Global Income Fund

The Artemis Global Income I Inc Fund was launched on 19 July 2010 and now manages £1.767 billion. It aims to grow both income and capital over five years by investing primarily in dividend-paying companies worldwide. The fund typically holds 80% to 100% in equities, with the flexibility to allocate up to 20% to bonds, cash, and near-cash instruments.

Its portfolio consists of 50–80 stocks, balancing large, stable businesses with high-growth mid-sized companies. This approach provides resilience while allowing for strong performance. To manage risk and improve efficiency, the fund also uses derivatives as part of its strategy.

The fund’s performance has been consistently strong. Over the past year, it delivered 28.24%, more than double the sector average of 12.55%, making it the top performer among 56 funds in its category. Its three-year return of 37.73% and five-year return of 69.84% also outpaced the sector averages of 21.22% and 47.01%. This track record places it among the strongest performers in the IA Global Equity Income sector.

A diversified sector allocation has been instrumental in the fund’s strong performance, with a strategic focus on financials, industrials, and energy sectors known for stability and sustained growth. These segments have consistently boosted returns and are projected to remain among the most influential growth sectors in 2025. The fund also gains from a varied regional presence, particularly in the United States, the Eurozone, and Japan, offering access to thriving economies and rising corporate earnings.

Moreover, the dedicated focus on Environmental, Social, and Governance (ESG) factors supports a responsible and forward-thinking investment approach. This aligns with growing investor demand for ethical investing while enhancing long-term value creation.

Artemis Monthly Distribution Fund

The Artemis Monthly Distribution I Inc Fund is designed to provide investors with monthly income alongside capital growth over a five-year horizon. It achieves this by investing 60% in bonds and 40% in global equities, balancing income stability with growth potential. The fund currently manages £910.3 million of assets.

In addition to its core investments, the fund may hold near-cash instruments, transferable securities, and other funds, including up to 10% in Artemis and third-party funds. It also employs money market instruments and derivatives to enhance risk control and operational efficiency. A team of investment specialists actively curates the portfolio, ensuring a measured balance between risk and reward amid changing market conditions.

Over the past year, it grew by 16.25% outshining the sector average of 6.69% and earning the top spot among 187 funds. Over three years, it returned 17.42% cumulatively, far exceeding the sector average of 3.27%, while its five-year return of 32.99% was more than twice the sector average of 14.55%. These standout results cement its place among the top performers in the IA Mixed Inv 20-60% Shares sector.

The fund’s solid performance is largely attributed to its diverse investment mix, which blends the income stability of bonds with the high-growth potential of equities. The fund’s top holdings include Oracle Corporation and Newmont Corporation, further strengthening its growth prospects.

With an ongoing charge of 0.86%, lower than the sector average of 1.02%, the fund is cost-efficient, allowing investors to retain more of their returns over time. It also integrates Environmental, Social, and Governance (ESG) principles, making it an appealing option for ethically conscious investors.

Artemis SmartGARP Global Emerging Markets Equity Fund

Introduced on 8 April 2015, the Artemis SmartGARP Global Emerging Markets Equity Fund currently oversees £1.199 billion in assets. Its core aim is to generate capital growth over five years by allocating 80% to 100% of its portfolio to company shares within emerging markets. The fund also retains the flexibility to invest up to 20% in bonds, cash, near-cash instruments, and other financial vehicles such as collective investment schemes and money market instruments.

The fund has delivered notable returns over multiple time frames, achieving growth of 18.99%, 22.08%, and 40.80% over the past 1, 3, and 5 years, respectively. In comparison, the sector averages for these periods were 11.65%, 0.46%, and 14.9%.

A major contributor to the fund’s success is its SmartGARP investment strategy, which leverages data-driven insights to identify undervalued companies with strong growth potential. By analysing key financial indicators such as valuation and earnings momentum, the fund effectively adapts to shifting market conditions, ensuring a resilient and well-balanced portfolio.

Furthermore, its targeted investments in high-growth industries, such as financial services, consumer cyclicals, and technology, have played a crucial role in its robust returns. This strategic focus makes it an attractive choice for investors seeking exposure to emerging markets.

The fund maintains a competitive 0.86% ongoing charge and justifies its cost with superior, above-average returns.

Artemis UK Select Fund

The Artemis UK Select I Acc Fund has built a strong reputation as a consistent top performer in the IA UK All Companies sector. It is the 2nd highest growth fund featured in the above table and holds the largest assets at £3.70 billion.

Over the past year, the fund recorded a return of 24.92%, beating the sector average of 8.34%, placing it first in its category. Its three-year growth of 34.06% was markedly higher than the sector benchmark of 6.30%. Over five years, it delivered an impressive 68.42% return, leaving behind the sector average of 15.92%, and once again claiming the number one position out of 203 funds. These figures demonstrate the fund’s ability to generate competitive returns over varying time periods, earning it a 5-star rating.

The fund’s primary goal is to achieve capital growth over a five-year period by investing primarily in UK company shares. It allocates 80% to 100% in equities, with up to 20% flexibility in bonds, cash, and near-cash instruments.

Following a ‘best ideas’ strategy, the fund selects 40 to 60 high-potential stocks without adhering to a benchmark. It adopts a flexible, market-cap agnostic approach, allowing investment in companies of any size based purely on potential returns rather than index weightings. The fund can take short positions, profiting from both rising and falling markets. Macroeconomic trends guide stock selection, aligning with broader economic conditions. Additionally, ESG factors are integrated to promote responsible investing.

The fund is primarily weighted in financial services, with major holdings in Barclays, Standard Chartered, and NatWest, all of which have contributed to solid returns. As one of the best performing sectors in recent years, financials are expected to sustain their momentum this year, further supporting the fund’s growth.

Key Benefits of Evaluating Fund & Fund Manager Performance

Analysing a fund’s performance provides valuable insights that are essential for making informed investment decisions. Here are four key advantages:

1. Understanding Past Performance

Although past performance does not guarantee future success, it remains a useful indicator for investors. When selecting where to invest, most investors favour fund managers who have consistently ranked in the top 25% of their sectors rather than those in the bottom 25%. This historical data offers insights into a fund manager’s reliability and investment strategy, helping investors make more confident decisions.

2. Comparing Fund Performance

Comparing a fund’s performance against other funds in the same sector helps determine its relative strength. A comparative analysis over medium to long-term periods can highlight the fund's quality and the expertise of its manager. Understanding how a fund ranks among its peers allows investors to identify those that align best with their financial objectives.

3. Assessing Fund Manager Accountability

Past performance is a useful tool for assessing fund managers’ accountability. Funds that consistently perform well within their sector often reflect strong managerial expertise. Conversely, fund managers whose funds frequently underperform may indicate weaker management capabilities and an inability to generate competitive returns. By analysing performance, investors can select managers who demonstrate effective strategies and sound investment management skills.

4. Consistent Performance Across Market Cycles

Over five years, funds and managers face various economic and political challenges. A fund manager’s ability to navigate these fluctuations while maintaining stable or superior returns reflects their skills and competence. Funds with a proven track record across different market cycles are more likely to attract investors seeking long-term reliability.

Top League Table Fund Ranking

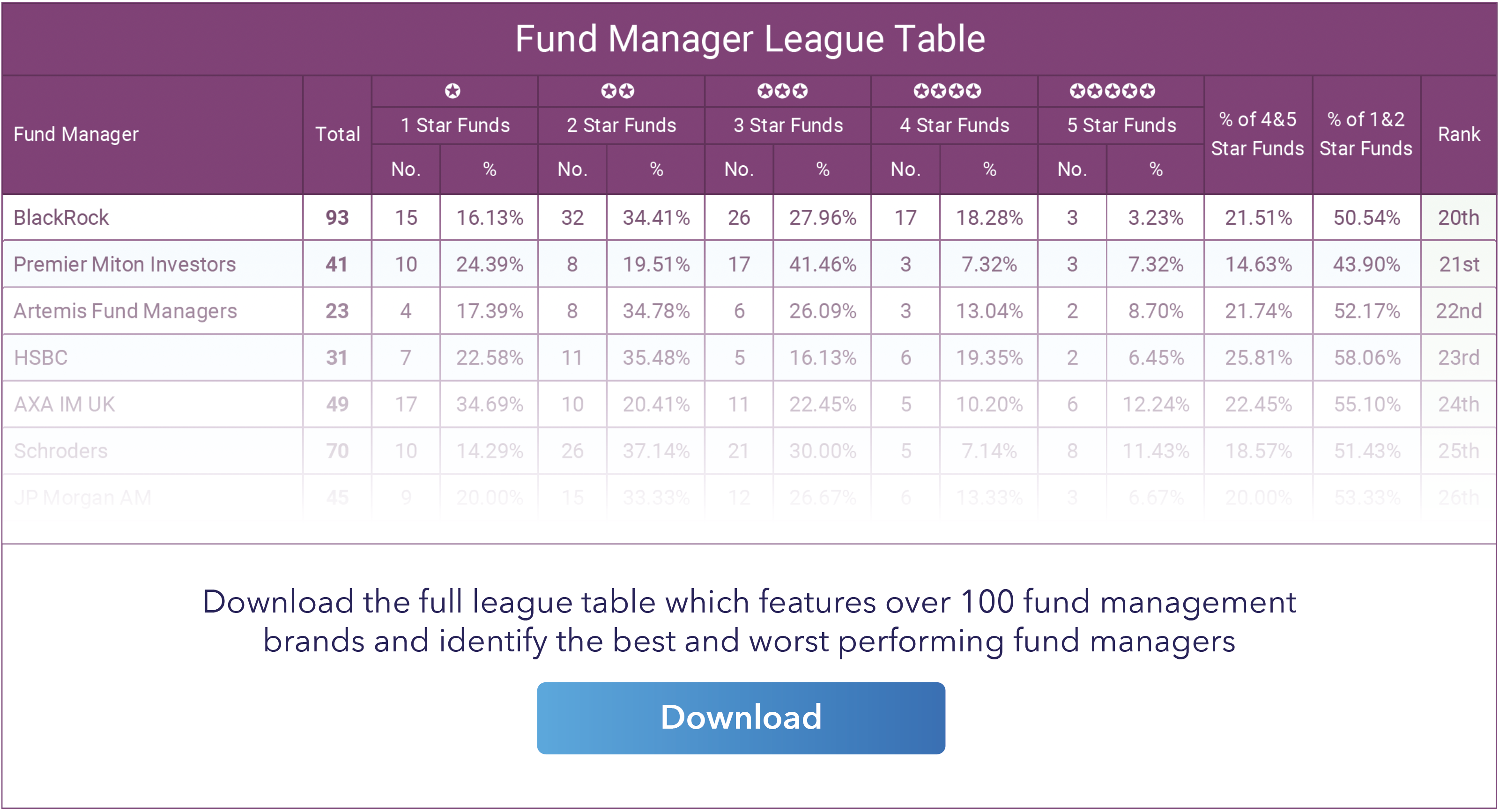

Artemis claimed the top spot in our 2024 fund manager rankings, reflecting its exceptional performance and dedication to creating value for investors.

It also ranked 1st in our Fund Manager League Table, managing the highest proportion of 4 & 5-star funds, which is based on 1, 3, and 5-year performance.

This achievement showcases not only their short-term success but also their sustained excellence in fund management.

Summary

To maximise portfolio returns, investors must identify top-performing funds while avoiding underperformers, regardless of the provider.

A strategic approach and diversified portfolio are vital for managing risk and ensuring long-term success. No single sector consistently leads, so spreading investments across asset classes and regions helps maintain stability and growth. Identifying the best-performing funds within each asset class helps protect your financial future.

How Efficient Is Your Investment Portfolio?

Inefficient investing will undoubtedly have adverse long-term consequences. It is important to identify and correct any portfolio deficiencies.

For years, Yodelar has analysed the performance and quality rating of portfolios for thousands of UK investors. Our extensive analysis has uncovered that over 90% of investors hold portfolios containing inefficiencies that stunt growth potential, resulting in many UK investors to miss out on enhanced portfolio growth.

Our industry leading portfolio analysis service enables investors to find out how their portfolio compares to a similar risk-profile portfolio constructed with top-performing funds. This unique tool provides measurable ratings that offer complete transparency into the quality of individual fund choices and the overall portfolio's competitiveness.

By using our portfolio review feature, investors gain valuable insights into their investments and can determine whether their strategy is optimally structured for growth.

Key Benefits Include:

- Assess the performance of each fund

- See where each fund ranks within its sector over 1, 3, and 5 years

- Find out each fund's performance rating between 1 to 5 stars

- Identify the proportion allocated to top, mediocre, or underperforming funds

- Compare portfolio growth against model portfolios built with consistently top-performing funds

- Receive an overall portfolio performance grade from A to F