- Of the 95 Aegon funds analysed, 44 have a high performance rating, while 37 of their funds have consistently underperformed.

- The Aegon Global Equity Income fund has been one of the best performing funds in the Global Equity Income sector over the past 5 years. This fund outperformed 98% of the funds in this sector over this period.

- Out of the 5 Aegon Retiready funds, three rank among the top performers over 1, 3, and 5 years.

- Our analysis of the Aegon LifePath pension funds identified that 32.4% are rated as poor-performing 1 or 2 star funds. 13.9% received a modest 3 star rating, and the remaining 53.7% consistently outperformed the majority of their peers, earning an impressive 4 or 5 star rating.

With a 190 year history, Aegon is one of the longest serving financial institutions in the UK. Initially branded as Scottish Equitable, Aegon have now established themselves as a brand synonymous with pension and protection plans. With their range of pension and ISA funds among the most popular on the market in this report, we will analyse their performance and identify their best funds and pension portfolios.

Aegon Fund Review

Aegon currently serves 3.8 million customers with a diverse range of investment options, managing approximately £266 billion in assets. Founded in 1831 and originally branded as Scottish Equitable, Aegon has established itself as a brand synonymous with pension and protection plans. With a nearly 190-year history, Aegon is one of the UK's longest-serving financial institutions.

Aegon Fund Performance Summary

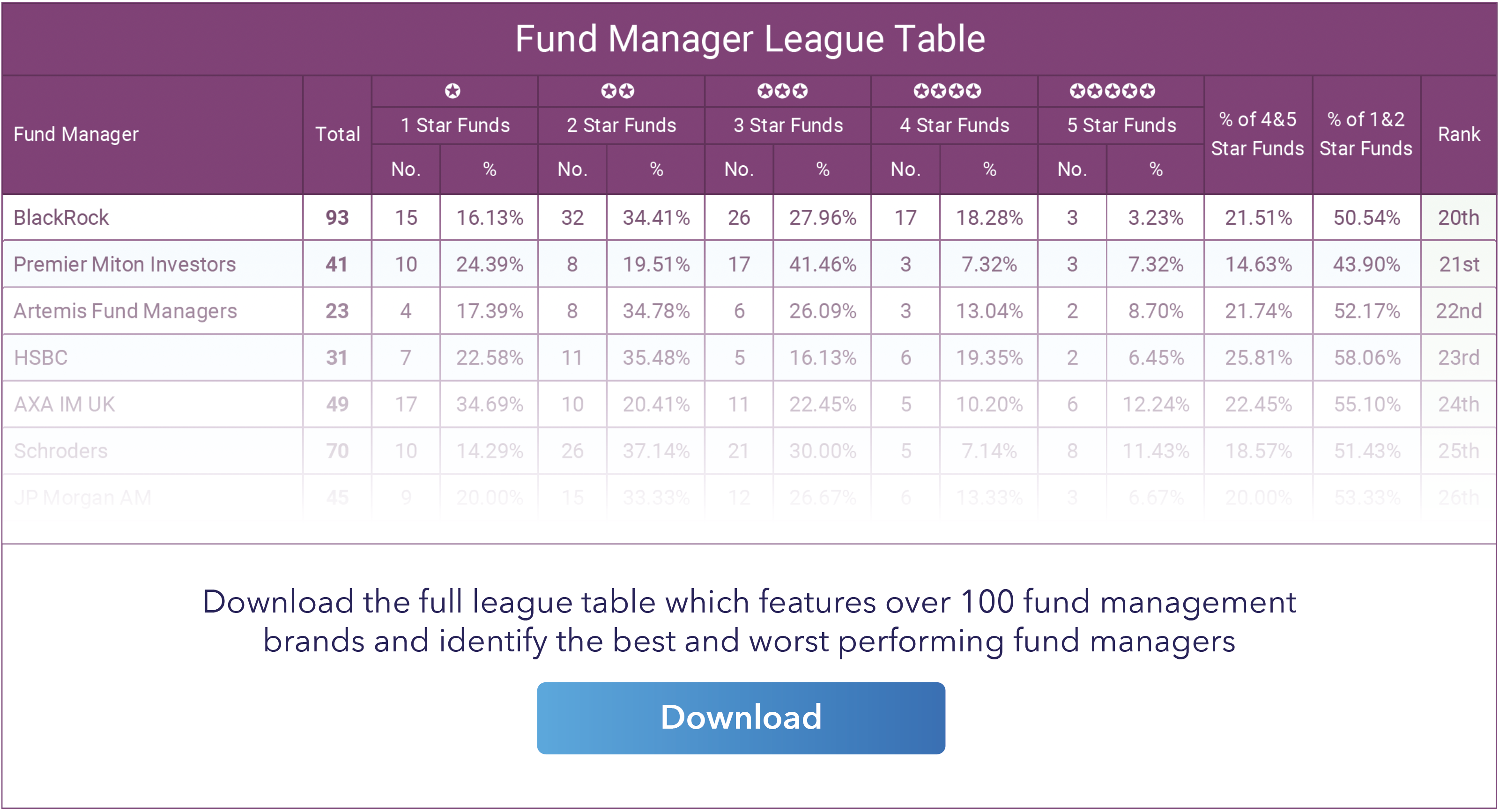

We analysed 95 Aegon funds for performance and sector ranking over the past 1, 3 and 5 years and provided each fund with an overall performance rating between 1 and 5 stars.

The above summary identifies the number and percentage of the 95 Aegon pension and ISA funds analysed based on their performance rating. An impressive 46% of Aegon funds received a high 4 or 5 star rating by consistently ranking among the best performing funds in their respective sectors. In contrast, 39% of Aegon funds consistently underperformed the sector average and received a lowly 1 or 2 star rating.

Aegon ISA Funds

From the 95 Aegon funds analysed 19 were from their range of unit trust/ISA funds. Combined, these 19 funds manage £6.6 billion of investor assets.

Aegon Diversified Monthly Income

The largest of these funds is the Aegon Diversified Monthly Income fund with some £857 million under management. Our analysis of this fund identified consistently strong performance with the fund returning growth of 13.07%, 9.79% and 19.34% over the past 1, 3 & 5 years respectively. In comparison, the IA Mixed Investment 20-60% Shares sector (which is the sector this fund is classified within) averaged 1, 3 & 5 growth of 10.14%, 3.41% and 16.04%.

Aegon Global Equity Income

The 2nd largest fund in Aegon’s unit trust range is the Aegon Global Equity Income Fund which currently manages £790 million. This fund primarily invests in global equities, focusing on mature markets across North America, Europe, and Asia-Pacific. Its main asset class is large-cap stocks, though it may also include some mid-cap companies.

The fund typically holds a significant portion in U.S. equities, given the size and depth of the American market. European stocks, including the UK, also form a substantial part of the portfolio.

The fund has consistently outperformed its sector peers. Over 1, 3, and 5 years, it achieved returns of 22.97%, 40.56%, and 74.78% respectively, compared to sector averages of 15.63%, 25.55%, and 50.22%. This outperformance can be attributed to skilled stock selection, global diversification, emphasis on dividend growth, and effective risk management.

Aegon Sustainable Diversified Growth

3 of Aegon’s 19 unit trust/ISA funds received a poor performing 1 star rating with each of these funds ranking among the bottom quartile of their sectors. The fund with the worst sector ranking was the Aegon Sustainable Diversified Growth fund. Over the past 1, 3 & 5 years the fund has returned growth of 6.90%, -9.68% and 7.05% compared to the sector average of 13.11%, 8.47% and 28.08%. To put this performance into perspective, for each of the 3 periods analysed the fund has been outperformed by 98% of the funds in its sector.

Aegon Risk Managed Portfolio

In July 2020, in response to the rise in market volatility from the Covid19 pandemic, Aegon rolled out a series of 6 risk managed, multi asset portfolios. Each portfolio targets a specific risk level and they each invest across various asset classes, including equities, bonds, and alternative investments, to achieve diversification.

The Aegon Risk Managed Portfolios offer UK investors a comprehensive range of six multi-asset funds designed to cater to varying risk levels. Launched in July 2020, these portfolios aim to deliver optimal returns by balancing equities, bonds, and cash, adjusting asset allocation based on market conditions. Among the 6 funds in this portfolio, we analysed the best and two worst-performing funds over 1 & 3 years.

Unsurprisingly, the most adventurous model in the range, the Aegon Risk Managed 6, has delivered the highest returns. This fund currently manages £95.91 million and has consistently been one of the best-performing funds within the IA Volatility Managed sector since its launch. Over the past 1 and 3 years, this fund achieved impressive growth of 17.07% and 27.51%, which were both considerably greater than the sector average. All bar the lowest risk 1 and 2 funds outperformed the sector average over the past 1 & 3 years with their less defensive models showing their quality. Combined with low annual charges between 0.25% and 0.30% they have shown their value.

In contrast, the Aegon Risk Managed 1 A Acc and Aegon Risk Managed 2 A Acc funds have significantly underperformed. The Aegon Risk Managed 1 A Acc has shown a 1-year growth of merely 7.51% and a 3-year performance of -2.62%, highlighting its challenges in achieving positive returns, which has led to its 1-star rating. Similarly, the two-star rated Aegon Risk Managed 2 A Acc has underperformed, with 1 & 3 year returns of 8.96% and 2.34%.

Overall, except for the two top performing funds, the Aegon Risk Managed portfolio has largely underperformed compared to its peers over the periods analysed. Many of the funds in this portfolio have struggled to deliver competitive returns. Each fund aims to deliver long-term capital growth through diversified asset allocation and strategic risk management.

Aegon Retiready Pension

In early 2014, Aegon released 'The Aegon UK Readiness Report,' a comprehensive study based on interviews with 4,000 individuals throughout the UK. The report aimed to evaluate the adequacy of retirement savings among UK citizens and found that only 7% of pension savers were nearing their goal to afford their desired retirement lifestyle. Following the release of this report, Aegon introduced its Retiready platform, which offers free online planning tools and resources specifically for investors looking to take more control over their pension management.

The top performer in the range was the Retiready Solution 5, which invests in the BlackRock Volatility Strategy IV fund. This fund has consistently delivered very strong returns and over the past year it has outperformed 99% of funds in its sector with growth of 19.34% compared to the sector average of 9.32%. This fund, aimed at higher risk investors, focuses on long-term capital growth with a portfolio predominantly comprising equities (80% - 100%).

The Retiready Solution 2 was the only one in the Retiready range to underperform the sector average over the past 3 & 5 years. This fund delivered 5 year returns of 16.67%, ranking it 302nd out of 516 in its sector and well below the 21.3% sector average.

Aegon LifePath Pensions

The Aegon LifePath pension range of funds aims to provide investors with an investment solution that automatically and gradually moves their savings as they near their target year of retirement to reduce risk and to align the fund to the way they intend to draw their benefits at retirement.

There are 3 types of Lifepath funds - the Lifepath Flexi, Lifepath Capital and Lifepath Retirement range.

LifePath Flexi Fund – this fund is designed for those who plan to leave their retirement savings invested during their retirement and to draw an income or one-off amounts from their savings.

LifePath Retirement Fund – this fund is designed for those who plan to take 25% of their savings as a cash sum and to use the remainder to buy an annuity.

LifePath Capital Fund – this fund is designed for those who plan to take the whole of their retirement savings as a one-off cash sum.

Combined, there are a total of 65 LifePath funds, and as identified in our analysis, the majority have consistently ranked among the top performers in their sector over the past 1, 3 & 5 years. However, the majority of LifePath funds that are underperforming are those where their target retirement date is within the next few years, which is likely to be of concern to the LifePath members nearing retirement.

Our analysis of the Aegon LifePath pension funds identified that 32.4% are rated as poor-performing 1 or 2 star funds. 13.9% received a modest 3 star rating, and the remaining 53.7% consistently outperformed the majority of their peers, earning an impressive 4 or 5 star rating.

Aegon Workplace Pension

Aegon's workplace pension is a savings scheme established by UK employers to help employees save for retirement. Employees are automatically enrolled if they meet specific criteria, such as being over 22 years old and earning more than £10,000 annually. The plan involves contributions from both the employer and employee, which are invested over time. The minimum contribution is 8% of qualifying earnings, with at least 3% from the employer.

Aegon offers various investment options, including the default fund that adjusts investments as retirement approaches. For those who prefer more control over their investments, Aegon provides options to choose from over 5,000 investment funds.

The Aegon Workplace Default fund, launched on 1 May 2018 with a current size of £5.7183 billion, is designed to grow your savings over the long term by investing in a diversified mix of assets. Six years before your target retirement date, the fund gradually and automatically transitions into less risky investments.

The above chart illustrates that Aegon Workplace Default (ARC) Pn has delivered robust performance over the periods analysed. Over six months, it achieved 8.61% growth. Over the past 1, 3 & 5 years, the fund has posted returns of 12.23%, 14.21%, and 33.31%.

Default workplace pension funds play a crucial role in the retirement planning of most employees, as over 95% of workers typically do not choose an alternative to their scheme’s default investment option. These funds automatically receive pension contributions unless employees actively select specific investment vehicles. Evaluating the investment quality and performance of these default workplace pensions is therefore essential.

Book a free, no-obligation call to discuss high-quality investment options for your pension or ISA.

Diarise A No Obligation Call With Our Advice Team

Summary

Our analysis identifies that46% of Aegon funds received an impressive 4 or 5 star performance ratings, showcasing Aegon's ability to consistently deliver strong returns across most of its offerings. Despite a large portion of Aegon funds ranking highly for performance, like all fund managers, they also have funds that have struggled and consistently underperformed.

Evaluate Your Fund Performance

Evaluating fund performance is a crucial metric for investors and reputable advisory firms. Understanding how your funds are performing will help to identify if you are entrusting your money to fund managers who are delivering competitive returns. While past performance does not guarantee future results, research shows that fund managers who have consistently outperformed their peers across various time horizons are more likely to do so going forward than those with a history of underperformance.

There are 3 key benefits of understanding fund performance

Past Performance

Past performance is not an indicator of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform, over varying time frames, in the top 25% of performers in their sectors versus fund managers that perform in the worst 25% of performers.

Comparative Performance

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares over the medium to long term can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability

Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank low within their sector demonstrate a lack of quality and an inability to deliver competitive returns for investors.

Optimise Your Investments With Yodelar

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall. Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

Book a no obligation call with one of our advisers to learn more about your options and how we can help you maximise your portfolio returns.