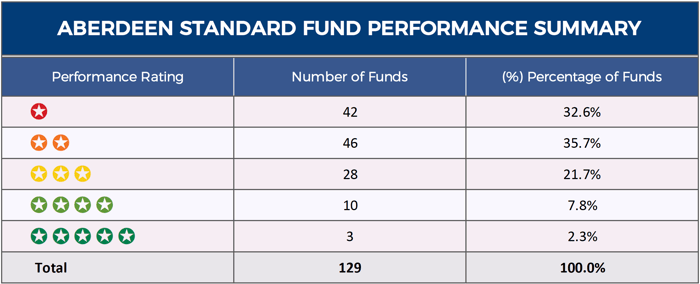

- 68.3% of the 129 Aberdeen Standard funds have regularly ranked among the worst performers in their sectors.

- Over the past 5 years the ASI UK Recovery Equity fund returned growth of 14.89%, which ranked 217th out of 228 funds.

- From the 129 Aberdeen Standard funds analysed only 10.1% of received a 4 or 5-star performance rating with the sizeable portion of their funds consistently underperforming.

The £11 billion deal to merge fund management giants Aberdeen Asset Management and Standard Life resulted in the creation of the UK’s largest and Europe’s 2nd largest fund manager. Operating under the brand Aberdeen Standard Investments, the investment arm manages £670 billion of client assets.

At the time of the merger, Martin Gilbert, Chief Executive of Standard Life Aberdeen, stated that “The merger deepens and broadens our investment capabilities, and gives us a stronger and more diverse range of investment management skills as well as significant scale across asset classes and geographies. We believe this will enable us to deliver an even better proposition and service to our enlarged client base."

To assess the performance of their funds we analysed 109 Aberdeen Standard unit trust and OEIC funds as well as their 20 Investment trusts over the recent 1, 3 & 5 years and rated each fund based on how they performed in comparison to all other competing same sector funds.

In this analysis, we identify how the majority of Aberdeen Standard funds continue to be plagued by poor performance.

Aberdeen Standard Investments Fund Performance

To identify the performance and sector ranking for all 109 Standard Life Aberdeen unit trust & OEIC funds and their 20 Investment trusts we compared their performance over the recent 1, 3 & 5year period, up to 1st August 2019, to every other competing fund within the same sector.

The Best Aberdeen Standard Funds

From the 129 Aberdeen Standard funds analysed only 10.1% of received a 4 or 5-star performance rating with the sizeable portion of their funds consistently underperforming. Although only a small proportion of their funds received a good performance rating, this small range has consistently delivered highly competitive performance and are among the top performers in their sectors.

ASI Europe ex UK Equity Fund

The £258.7 million ASI Europe ex UK Equity fund has consistently been one of the top performing funds in the Europe excluding UK sector. The Fund invests in a broad spread of European companies which offer good prospects for capital growth.

Over the recent 1, 3 & 5 years this fund returned growth of 9.63%, 51.32% and 73.96%, which were well above the sector average of 1.79%, 33.41% and 56.46% for the periods.

ASI Financial Equity Fund

The Fund aims to provide capital growth, whilst not excluding the occurrence of income, by investing predominantly in Equity and Equity-Related securities issued by financial institutions, such as banking, insurance, financial services and property companies, domiciled globally.

Since its launch 5 years ago the ASI Financial Equity fund has delivered growth of 86.29%, which was almost double the sector average, and higher than 85% of funds within the same sector. The fund has consistently been one of the top ranked funds in its sector and represents one of Standard Life Aberdeen’s best performing funds.

ASI UK Responsible Equity Fund

The Fund invests 80% or more of its total net assets in UK equities. As well as choosing companies on the basis of their financial record, management and business prospects, the Manager will also consider environmental, social and other relevant criteria. Where the Manager believes that practices relating to these criteria are lacking they will encourage the company to adopt more responsible practices. The fund currently invests in industrials and financial services companies and has holdings in Experian, Prudential and the London Stock Exchange Group.

Since its launch on 9th May 2006 until 1st August 2019, the ASI UK Responsible Equity fund returned growth of 118.40%. Over the recent 1, 3, & 5 years it has consistently been one of the top performing funds in the IA UK All Companies sector.

ASI European Smaller Companies Fund

The Fund invests 70% or more of its total net assets in equities from European smaller companies. These companies are generally those valued at less than €5 billion at the time of investment. The Fund's equity investments can include equities and equity related securities that are issued by companies that are incorporated, or generate a significant part of their earnings, in Europe.

Over the recent 1 & 3 year periods this fund returned growth of 6.18% and 63.94% which were the highest in the entire IA European Smaller Companies sector.

ASI UK Mid Cap Equity Fund

In recent months, UK markets have once again experienced turbulence with growing panic as the prospect of a no-deal Brexit intensifies. As a result, UK funds have taken a hit in recent weeks. However, despite the challenges faced by UK Equities one of the most consistent top performers has been the ASI UK Mid Cap fund. This fund currently manages £56 million of client assets, and over the past 1, 3 & 5 years it has returned growth of 6.48%, 40.96%, and 55.77%, which were among the highest in the sector.

Underperforming Aberdeen Standard Investment Funds

A significant 68.3% of the 129 Aberdeen Standard funds analysed for this report have regularly ranked among the worst performers in their sectors with consistently better performing alternatives available to investors. The 5 funds featured below represent some of their most disappointing funds.

ASI UK Recovery Equity Fund

Launched in March 2009, the ASI UK Recovery Equity fund currently manages in excess of £142 million of client assets. The fund is primarily invested in 'recovery' shares listed on the UK stock market and these will generally be companies of a large and medium size. The fund is classified within the competitive UK All Companies sector where it has consistently been one of the worst performing funds.

Over the past 12 months it returned losses of -23.27%, which was worse than 99.6% of funds in its sector and over 5 years it returned growth of 14.89% which ranked 217th out of 228 funds.

ASI Diversified Income Fund

The Fund invests more than 50% of its total net assets in worldwide equities and bonds, with the remainder invested in other asset classes such as cash, property and infrastructure. In recent years this fund has been one of the worst performers in its sector with 1, 3 & 5 year returns of 0.37%, 11.75%, and 22.96%, which were all well below the sector average.

ASI Emerging Markets Bond

The ASI Emerging Markets Bond invests 70% or more of its total net assets in corporate bonds or government bonds based in emerging market countries. It is one of 50 funds classified within the IA Global Emerging Markets Bond sector and over the past 12 months the fund ranked 45th with growth of 8.21%, which fell well below the 13.32% sector average. The fund has persistently struggled and over 5 years this fund returned growth of 16.83%, which was the 2nd lowest in its sector.

ASI MyFolio Multi Manager I Fund

The ASI MyFolio Multi Manager I fund is part of the MyFolio Multi-Manager range, which consists of five funds with different expected combinations of investment risk and return levels. The fund is risk level I, which aims to be the lowest risk fund in this range. The range in general has been disappointing as they have delivered some of the lowest returns in their sector with the ASI MyFolio Multi Manager I fund returning 2.81%, 8.76%, and 17.86%. In contrast, the average sector growth for these periods was 4.18%, 19.88% and 36.52% respectively.

ASI Japanese Growth Equity Fund

The fund aims to provide long term growth and is designed for investors who are looking for exposure to the Japanese equity market. The fund invests predominantly in the shares of companies listed on the Japanese stock markets and it is actively managed. Please note that the Japanese equity exposure in this fund is currently managed by Sumitomo Mitsui Trust Bank, one of Japan's leading domestic equity managers.

This fund has consistently been one of the worst performing funds in the IA Japan sector and over the recent 5 years it returned cumulative growth of 58.39%. In comparison, the sector average for the same period was 73.35%.

Aberdeen Standard Investment Trusts

Aberdeen Standard Investments are the 4th largest provider of Investment Trusts in the UK with their 20 Investment Trusts responsible for total assets of £10 billion.

Aberdeen Smaller Companies Income Trust

The Aberdeen Smaller Companies Income Trust aims to provide a high and growing dividend and capital growth from a portfolio invested principally in the ordinary shares of small companies and UK fixed income securities. The trust invests primarily in Financial and Industrial companies with holdings in asset manager, Intermediate Capital and recruitment company FDM.

Over the past 10 years this trust has generated growth of 410.16% as it consistently ranked within the top half of its sector for performance.

Murray Income Trust

The Murray Income Trust aims to achieve a high and growing income combined with capital growth through investment in a portfolio principally of UK equities. Established in 1923, the trust now has total assets under management totalling £565 million. The Murray Income Trust is one of the most popular in the AIC UK Equity Income sector and it has consistently delivered above average returns for investors. Over the past 1, 3 & 5 years the trust has returned growth of 11.79%, 35.42% and 33.86% respectively.

Dunedin Income Growth Investment Trust

Dunedin Income Growth (DIG) sits in the UK Equity Income sector, aiming to grow capital and income in excess of the FTSE All Share. The trust is unique within the AIC sector due to its large exposure to European stocks, helping the managers to diversify their distributions and take advantage of their extensive knowledge of the PanEuropean space. The trust has a competitive performance history and over the recent 1, 3 & 5 years it returned growth of 12.35%, 30.88%, and 28.13%, which were comfortably above the sector average for the periods.

The Worst Performing Aberdeen Standard Investment Trusts

Aberdeen Diversified Income & Growth Trust

Aberdeen Diversified Income and Growth Trust (ADIG) follows a diversified multi-asset approach, aiming to generate attractive long-term income and capital returns. The managers aim to hold a genuinely diversified, global, multi-asset portfolio of investments with differing return drivers and risk characteristics.

Performance has been mixed since the appointment of Aberdeen Standard Investments (ASI) as manager in February 2017, but positions in longer-term, less liquid investments, typically only accessible to large investors, are steadily being built up.

Over the recent 12 months this trust returned losses of -11.30% and over the past 5 years its returns of 20.82% ranked in the bottom half of its sector.

Aberdeen Frontier Markets Investment Co.

The Aberdeen Frontier Markets IT invests primarily in equity and equity related securities of companies listed in, or operating in, Frontier Markets. Performance wise, this trust has consistently struggled and over the past 5 years it returned losses of -12.12%, which were the worst in the AIC Global Emerging Markets sector.

Aberdeen Standard Equity Income Trust PLC

Aberdeen Standard Equity Income Trust invests in a diversified portfolio of predominantly quoted UK equities.

The long-standing manager, Thomas Moore, follows a different approach to many of his competitors when identifying opportunities. The end result is a portfolio very different to peers and the benchmark. A stand out characteristic of this is the bias towards the FTSE 250, offering exposure to considerably more growth companies than peers and a typical equity income trust. This is illustrated in the fact that over 60% of the portfolio is invested outside the FTSE 100, showing Thomas’s ability to find companies in unloved areas and take advantage of areas that other managers may be overlooking.

However, this strategy has yet to yield competitive performance and over the past several years it has consistently ranked among the lowest 50% in its sector for performance.

Aberdeen Standard Review

The big money merger between Standard Life and Aberdeen has resulted in the formation of the UK’s largest active fund manager, but unhappy with the merger, many of their investors decided to move elsewhere. Indeed, Aberdeen Standard Investments reported that outflows increased to £40.9 billion in 2018.

The sustained outflows is undoubtedly a concern for Aberdeen Standard which will not be helped by the fact their funds lack competitiveness and overall quality with our analysis identifying the majority to have continually underperformed.