As the deadline for this year's ISA season draws closer, it’s one of the busiest times of the year for investors with as much as half of all ISA investments occurring in the last three months of the tax year and 15% in the final two weeks alone.

But not everyone who invests their ISA allowance is making their money work as efficiently as it could, and many will make ISA decisions this year that will potentially increase their portfolio risk as well as result in them missing out on better returns .

In this article we look at the 5 main mistakes investors make when building their ISA portfolio.

ISA Options In A Nutshell

ISAs allow consumers to save or invest money without paying tax on any interest, dividends, or capital gains earned. The amount you can invest in an ISA is subject to an annual limit, which is currently set at £20,000 for the 2022/23 tax year.

Cash ISA: This type of ISA allows individuals to save money in cash, such as in a savings account or a cash ISA.

Stocks and Shares ISA: This type of ISA allows individuals to invest in stocks and shares, as well as unit trusts, open-ended investment companies (OEICs), and investment trusts.

Innovative Finance ISA: This type of ISA allows individuals to invest in peer-to-peer lending platforms, crowdfunding sites, and other alternative finance options.

Lifetime ISA: This type of ISA allows individuals to save for either their first home or retirement, with a government bonus of 25% on top of their savings, up to a certain limit.

Junior ISA: This type of ISA allows parents or legal guardians to save on behalf of a child, with the funds becoming available to the child when they turn 18.

There are 5 main types of ISAs available and below we list 5 of the most common mistakes that investors make when it comes to their ISAs.

-

1. Over Reliance On One Fund

A common mistake investors make, particularly self-investors, is to invest their ISA allowance entirely in one fund or in a portfolio with limited funds. Such an approach can have significant consequences regarding risk and performance.

Lack of diversification: Investing in just one fund results in an overreliance on one asset class, sector or geography, which will expose you to greater risk. If that asset class or sector performs poorly, the entire investment would drop in value and potentially have huge consequences when it comes to meeting your overall investment objectives.

Concentration risk: Even if the fund you have chosen is diversified, such as a multi-asset fund, it may still have a concentrated portfolio with a few holdings accounting for a large portion of its assets. If these holdings perform poorly, their impact will be magnified for those who have little or no diversification.

Manager risk: All funds are managed by individuals or teams with varying levels of experience and expertise. If the fund manager underperforms or leaves the fund, it can negatively impact the fund's performance.

Less protection: The Financial Services Compensation Scheme (FSCS) provides protection for investors if the firm that holds their investments, such as a fund manager, goes out of business and is unable to return the investor's assets. However, the FSCS will only compensate investors up to a maximum of £85,000 per person, per firm. This is an important factor that is often overlooked. It is therefore best practice to have a portfolio that invests in several funds across multiple firms to ensure maximum protection under the scheme.

In contrast, investing in a diverse and balanced asset allocation model will help mitigate these risks and improve the chances of long-term success.

A well-diversified portfolio shelters against the risk of losses if any one asset class, sector, or geography takes a hit or experiences increased volatility. If one holding performs poorly, the impact on the overall portfolio will be limited.

Investing across a variety of asset classes allows you to capture different sources of returns and potentially achieve a higher return than by investing in just one asset class. A balanced portfolio reduces the overall volatility of your investments, which can help you stay invested for the long term and avoid making emotional investment decisions.

-

2. A Poor Asset Allocation Strategy

The cornerstone of many an investment strategy is its asset allocation. Whether it’s a single asset class on which the strategy relies or a blended, multi-asset approach, it’s important to understand that different asset classes behave in different ways, at different points in the investment cycle. Yet this despite being one of the most critical aspects of investing it is also one of the most neglected.

One of the main reasons asset allocation is so important is because nobody knows with any degree of certainty what asset classes and global markets will be the best performers over different periods. Therefore, the most efficient way for investors to capture the returns of the markets is to invest with diversity and spread their portfolio's assets.

A study by the CFA Institute on ‘determinants of portfolio performance’ found that as much as 90% of an investment’s return can be down to asset allocation. Although there are many different asset allocation models available, they are each defined by risk. More specifically, what level of investment risk we are willing to tolerate in the pursuit of returns.

But for some, the lure of performance can lead them to make investment decisions that can have huge implications. For instance, when a particular sector such as the North American or the Technology sectors performs strongly, investors without a disciplined strategy may be tempted to abandon their asset allocation model to increase their exposure to these markets. But such an approach makes investors vulnerable to a market correction, which could have a huge impact on their chances of meeting their financial goals.

Being able to spread your risk across various countries shields investors from country-specific conflicts and regulations. In this way, if one country struggles economically due to regional issues, your portfolio will feel that it affects less.

-

3. Failure To Adjust Risk Levels

There are three key aspects of investing that must be considered and managed in order to maintain a suitable risk model. However, often these are overlooked or inadequately managed which for some investors exposes their portfolios to levels of risk that they are unaware of.

Portfolio drift: Over time, the performance of different investments in a portfolio can cause the portfolio to drift away from its original asset allocation. This can result in a portfolio that is overweight in certain assets or sectors and underweight in others. Without rebalancing, investors may be exposed to more risk than they intended and may miss out on opportunities for growth in other areas.

Changing life circumstances: An investor's risk tolerance and investment goals may change over time due to changing life circumstances, such as retirement, the birth of a child, or a change in employment. Failing to reassess risk levels and make adjustments to the portfolio can result in a mismatch between the investor's risk profile and the portfolio's asset allocation.

Market volatility: Financial markets are inherently volatile, and the performance of investments can change rapidly. Without regular rebalancing and risk assessment, investors may be caught off guard by sudden market changes, which can result in losses that could have been avoided or minimised with proper portfolio management.

A lack of portfolio rebalancing or reassessment of risk levels at different times of an investment journey could result in a portfolio that is too risky, too conservative, or misses out on opportunities for growth. Investors should regularly review their portfolios and make adjustments as necessary to ensure that they remain aligned with their financial goals and risk tolerance.

-

4. Investing With Banks or Restricted Fund Managers

There are more than 3,000 sector classified funds on the market with approximately 15% delivering returns that are consistently among the top of their sectors consistently over a 1, 3 & 5 year period. But the fact is, the majority of investment funds on the market are poorly managed, lack quality and underperform. With such a wide selection of options available and only a limited number of proven, high quality funds on the market it is important to maximise portfolio efficiency and growth potential. But two options that are common among investors can significantly limit this choice are investing with banks and investing with restricted fund management firms.

As Banks typically only offer a limited range of funds that are managed in-house or by affiliated asset management firms their ability to provide a diverse range of high quality options are greatly reduced.

The reality is bank-managed funds are not managed by specialist fund managers who have a deep understanding of the particular sector or asset class in which the fund invests. Despite this, the charges associated with investing in funds managed by banks are often higher than those from better performing, specialist fund managers.

Another choice investors make that can have a negative impact on the quality of their ISA portfolios is to invest in the funds of restricted investment firms.

The investment portfolios of fund management firms that offer a restricted advice service will typically only ever use their own small range of funds in the portfolios they invest their clients' money in. This approach significantly limits the number of quality options that are available to investors which can be detrimental to meeting performance objectives as no one fund management firm has top performing fund options across all core asset classes.

There are 4 main disadvantages of investing with restricted wealth managers:

Limited choice: Restricted investment advice means that you're limited to a smaller range of investments or providers. This can be problematic if the investments or providers offered do not meet your investment objectives or risk appetite. It can also mean that you miss out on potentially better investment options that are not available to you.

Conflicts of interest: Restricted investment advice can create conflicts of interest between the adviser and the client. The adviser may have an incentive to recommend a specific product or provider, even if it's not the best option for the client.

Lack of transparency: Restricted investment advice can lack transparency, making it difficult for clients to understand the fees, charges, and commissions involved. This can make it challenging to compare the costs of different products and providers and can lead to unexpected costs.

Less objective: Restricted investment advice can be less objective, as the adviser is limited to recommending products or providers within their restricted range. This can mean that the advice is not tailored to the client's specific needs and can be less independent.

We believe that by having access to funds across the whole market and with no allegiance to any fund manager, investors can benefit from an unrestrictive approach to investing that allows the freedom to make fund choices based on quality and suitability, which we believe is important in obtaining high level portfolio efficiency and performance.

-

5. Not Using Your ISA Allowance

Use it or lose it: Each tax year, you have an ISA allowance, which is the maximum amount of money you can invest in an ISA.

If an investor fails to use their full ISA allowance, they are missing out on the opportunity to earn tax-free growth on their investments. This means that any returns earned outside of the ISA wrapper will be subject to tax, which can reduce the overall returns on the investment.

Potential Loss of Future Allowance: Any unused ISA allowance does not roll over into the next tax year. This means that if an investor does not use their full allowance for a particular year, they lose the opportunity to invest that amount tax-free in the future. Over time, this could result in a significant loss of potential tax-free growth.

Invest In Quality

Investing your ISA in funds with a history of top performance from fund managers who specialise in each sector can maximise portfolio returns, minimise risk and improve efficiency.

Although future performance is never certain, research shows that the funds with a history of top quartile performance within their sector indicates that the fund manager has been able to consistently generate returns that are better than most of the other funds in the same category. This consistency of performance is a good indicator of the manager's skill in selecting investments and managing risk.

Fund managers who specialise in a particular sector have a deeper understanding of the industry and the companies operating within it. They are better equipped to identify opportunities and risks that are unique to that sector, and to make informed investment decisions based on that knowledge.

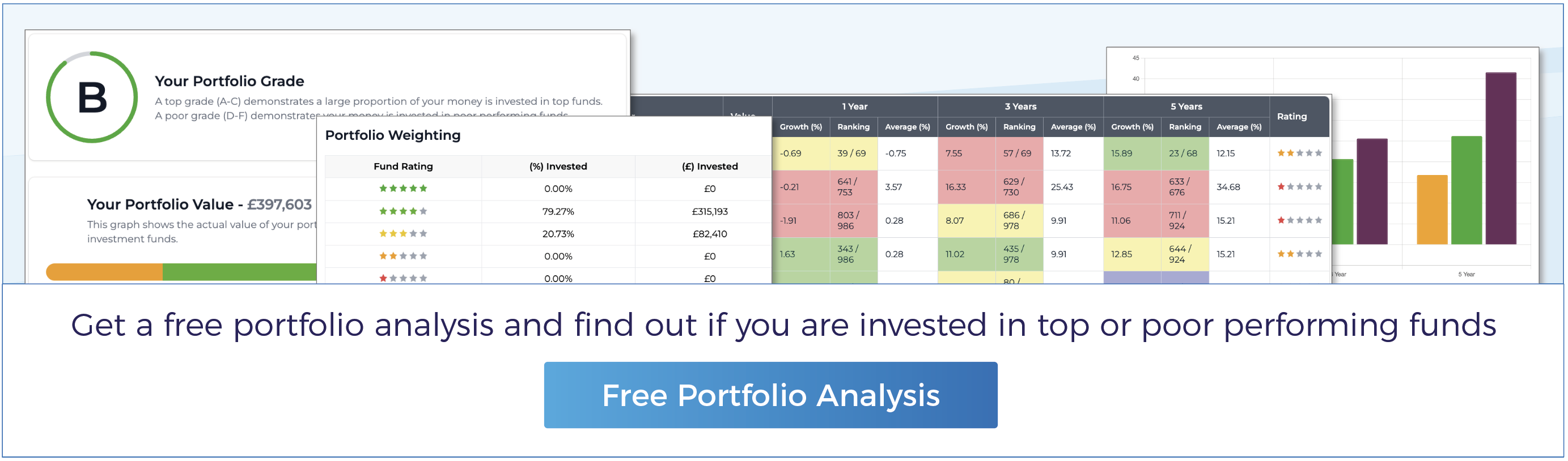

Get A Free Review of Your ISA Portfolio

Whether or not you believe your portfolio has delivered competitive returns, it’s true performance can only be established by comparing its growth to that of a similar risk portfolio of consistently top-performing funds.

The unfortunate reality is that the vast majority of investors could achieve greater growth from their investments, without increasing risk, by making more informed fund decisions and investing in funds that have proven their quality consistently over different time periods. Our portfolio analysis feature will clearly identify how efficient your portfolio has performed.

What our portfolio analysis will identify:

- The performance of each fund you are invested in.

- How a fund ranks within their sectors for performance over 1, 3 & 5 years.

- Yodelar performance rating for each fund you are invested in (1 and 5 stars).

- What proportion of your portfolio is invested in 1 to 5 star rated funds.

- Portfolio growth comparison with a similar risk portfolio of top-performing funds.

- Receive an overall Portfolio Grade (between A and F).

Our portfolio analysis service provides a clear insight into how each of your individual funds is performing while grading your entire portfolio based on its overall performance - making it easy to identify areas to improve. It is a unique service that provides investors with a panoramic view of their portfolio that helps to encourage more informed investment decisions, making it an essential resource for efficient investors.

Is Your Portfolio Optimised For The Future?

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall. Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research continues to identify that a small proportion of funds and fund managers consistently delivered top performance, with more than 90% of the portfolios we review containing funds that continually underdeliver. This research has enabled us to identify efficient processes and top-quality investments which we have utilised to create 10 strategically balanced, risk-rated portfolios that are built using only the top funds within each asset class and offer investors phenomenal potential for growth.

Yodelar provides an advice and information service that is changing the way investors think. Book a no obligation call with our team today and find out how we can help you grow your wealth efficiently.