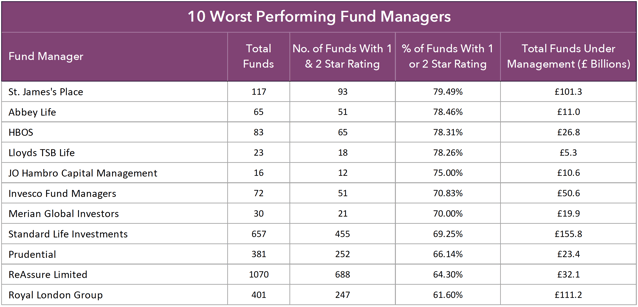

- From an analysis of 14,600 funds and 95 Fund management firms St. James’s Place ranked the worst performing fund manager for UK investors.

- The 10 worst performing managers are responsible for managing more than £500 billion of UK client money.

- Abbey Life, HBOS, Lloyds, Merian, Invesco, St James’s Place, Standard Life, Prudential, JO Hambro, Reassure, and Royal London, all ranked as the worst performing funds managers.

Some of the largest investment brands in the UK are among the worst performing, with wealth management giant St. James’s Place ranking the worst from an analysis of 95 firms. These 95 firms have a combined £5 trillion of client assets in over 14,600 funds across the unit trust, life and pension fund universes.

About This Report

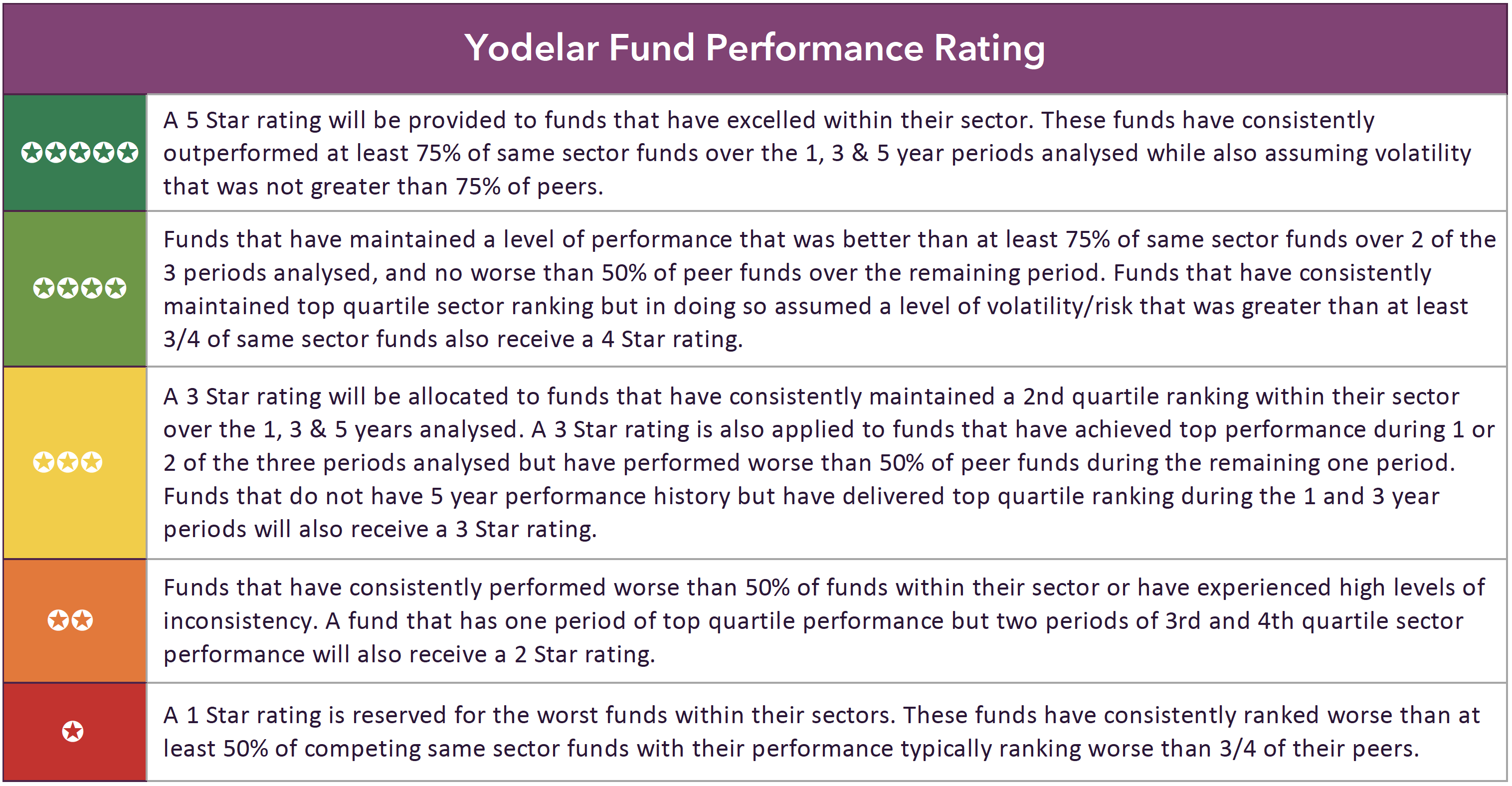

In order to provide a comprehensive fund manager ranking we reviewed 7,901 pension funds, 4,343 Life funds and 2,379 unit trust funds for performance over the past 1, 3 & 5 year periods. Each of these funds were then provided with a performance rating based on how they performed within their sector compared to all other same sector competing funds.

Each of the 95 asset managers were ranked based on the number of funds they manage, the percentage of these funds that have a poor performing 1 or 2 star rating, and the amount of client assets held within their funds.

St. James’s Place The Worst Performing Fund Manager

Our analysis identified St. James’s Place (SJP) as the fund manager with the largest proportion of underperforming funds with an excessively high 79.49% of funds receiving a poor performing 1 or 2 star rating.

To put this into perspective, Edinburgh based fund manager Baillie Gifford, one of the consistently better performing fund managers received a 1 or 2 star rating on 16.22% of their total funds.

With £101 billion of client assets held in the 117 St. James’s Place funds that were analysed, £76.2 billion of these assets were held in their worst performing funds. As a restricted wealth management firm (not whole of market) their advisers are only permitted to offer clients the funds offered by SJP. Their advisers have no option but to put client money into poor performing funds in order to ensure their client’s portfolios are appropriately balanced to meet their specific risk requirements.

SJP's largest fund is their Global Equity pension with £6.4 billion under management. This fund has consistently underperformed and over the recent 12 months it ranked 907th out of 982 funds in its sector.

The SJP Managed Growth Pension fund is SJP's third largest fund with £4.3 billion of client assets under management. Over the past 5 years this fund has been outperformed by three quarters of competing funds within the same sector.

The £1.4 billion SJP Multi Asset unit trust fund ranked 134th out of 134 funds in its sector with growth of 7.67% over the past 5 years.

These are just some of the underperforming funds that contributed St. James’s Place topping our list of worst performing fund managers.

Under New Ownership Abbey Life Funds Continue To Underperform

On 31 December 2018, all Abbey Life Assurance Company Limited (Abbey Life) policies transferred to Phoenix Life Limited (Phoenix) following approval by the High Court on 18 December 2018. This came 2 years after Phoenix Life bought the company from Deutsche Bank in a £900 million deal which saw them take control of the policies of Abbeys 735,000 clients with assets under management worth £11 billion.

Of the 65 Abbey Life branded pension and Life funds analysed 51 received a poor 1 or 2 star performance rating, equating to 78.46% of their funds. One of their largest funds was the Abbey Equity Pension Fund which manages £1 billion of client assets. This fund has consistently performed below the sector average and over the past 5 years it has ranked 502nd out of 786 funds in its sector.

69% of Standard Life Funds Underperform

Standard Life’s has endured a troubled few years since their merger with Aberdeen which has resulted in investors withdrawing billions from their funds forcing a job cull at the company and a restructuring of its board.

Despite their troubles, the 657 funds under the management of Standard life Investments hold £155.8 billion of client money, making them the largest fund manager in our 10 worst performing funds list.

With some 69% of their funds continually underperforming it is unlikely new investors will be attracted. Standard Aberdeen may be set for more outflows as investors look elsewhere for better performing alternatives.

Underperformance & Outflows Put Invesco Funds At Risk

With over £50 billion of client money invested across their range of 72 funds, made up of 54 unit trust funds and 18 pension funds, Invesco are one of the largest investment brands in the UK. However, 51 of their funds have underperformed with some of their most popular funds among their worst performers.

Invesco’s largest fund with £9 billion of assets under management is their Global Targeted Returns fund which over the past 5 years has returned growth of 6.86%, considerably lower than the 12.31% sector average. In recent years, it has been their flagship High Income fund that has been in the spotlight for underperformance ranked 218th out of 223 funds in its sector for growth over the past 5 years.

Managed by Neil Woodford's protégé Mark Barnett's the Invesco High Income fund could find itself struggling to meet investor demands for cash as early as November 2020 if withdrawals continue at the same pace as in recent months.

Investors took £750m out of the £5.7bn fund between October and December taking the total withdrawals to nearly £2bn last year. The fund has almost halved in size since the start of 2018 and there are now concerns that the Invesco High Income fund could have the same fate as Neil Woodfords Equity Income fund.

The Investment Funds of Some of The UK’s Largest Banks Continue To Struggle

Although HBOS plc have been defunct since their acquisition by Lloyds in 2009, HBOS investment fund managers continue to operate and currently manage £26.8 billion of client money across a range of 15 unit trust funds, 15 Life funds and 37 pension funds. Of these 83 funds 78.31% received a poor 1 or 2 star rating for performance, but it was their unit trust funds in particular that struggled with 14 of the 15 funds consistently performing below the sector average.

HBOS are a part of the Lloyds Banking Group along with prominent insurance and investment brand Scottish Widows, who represent the primary investment subsidiary of Lloyds. However, Lloyds themselves manage a small selection of 23 Life and Pension funds with combined assets under management of £5.8 billion. Last year Lloyds Banking Group announced it would plough £3 billion into a development strategy in which growth of their financial planning and retirement propositions will be key priorities. But our analysis of these funds identified that 18 have underperformed with consistently better performing alternatives available elsewhere.

Royal London’s Largest Fund Is Among Their Worst Performers

Across their group of companies Royal London oversee 401 unit trust, Life and pension funds with combined client assets under their management totalling £111 billion. Of these funds 401 funds, 61.6% have underperformed, the largest proportion of which came from their selection of pension funds.

The RLP Global Managed Pension is the largest fund in the Royal London fund range managing £19.6 billion of client assets, which equates to 17.6% of their total funds under management. Although their largest fund by a considerable margin, the RLP Global Managed pension has been one of the most disappointing performers. Over the past 5 years this fund has been outperformed by 78% of competing same sector funds.

Merian Global Investors Largest Fund Has Consistently Been One of The Worst In Its Sector

In 2018 Old Mutual Global Investors was rebranded as Merian Global Investors. Named after the name was chosen in tribute to Maria Sibylla Merian, a German scientist who debunked a number of myths of the time, they currently manage 30 sector classified funds with combined client assets under management of £19.9 billion. Of these 30 funds 21 received a poor 1 or 2 star performance rating with their most popular fund also one of their worst.

The Merian Global Equity Absolute Return fund is the largest Merian fund with £3.9 billion of client money under management, half of their total funds under management. Despite its size and popularity this fund has consistently performed poorly. Over the last 12 months it returned large losses of -12.51% and ranked 102nd out of 103 funds in its sector. Over the last 5 years it was outperformed by 93% of same sector funds and returned losses of -2.97%. To put this into context the sector average for the period was 12.31%.

Sub Par Performance From Prudential

The Prudential, became renowned for selling the relatively new concept of industrial branch insurance policies to the working class population for premiums as low as one penny through agents acting as door to door salesmen. The army of premium collection agents was for many years identified with the Prudential as the "Man from the Pru". In more recent years they have expanded their range of Life and Pension products which now manage in excess of £23 Billion of client assets within 381 pension and Life funds. Our analysis of these funds identified that 66% of Prudential funds have struggled receiving a poor performing 1 or 2 star rating.

The Majority of ReAssure Life and Pension Funds Have A Poor Performance History

Another fund provider with disappointing fund performance is ReAssure. They currently have approximately 2.2 million policies on their books, and look after investments of more than £32 billion on behalf of customers.

ReAssure is another fund provider with an extensive selection of funds on offer. In total, we analysed 1070 of their funds and identified that 688 have underperformed compared to same sector peer funds.

JO Hambro's Unit Trust Funds Are Among The Worst In Their Sectors

J O Hambro Capital Management (JOHCM) is an active investment management company who Globally manage £29 billion of client assets. In the UK they offer investors a compact range of 16 unit trust funds that currently hold £10.6 billion of client money. Although the fund range is small they cover a diverse range of asset classes including the UK, Europe, Japan and emerging markets but as identified from our analysis none of their funds have compared well against their peers for performance.

Their UK funds were among their worst performers with the JOHCM UK Growth fund ranking 212th out of 223 funds in the UK All Companies sector for performance over the past 5 years.

The Importance of Quality

The funds of the investment firms featured in this report have factually ranked among the worst performing in their various sectors. Such poor performance can have a detrimental effect on an investors overall portfolio. The funds of these 10 providers look after more than £500 billion of assets on behalf of UK investors.

The quality of funds that make up a portfolio have a significant bearing over the portfolio’s performance. An important indicator of quality and success is consistency, but less than 8% of investment funds have been able to maintain a top quartile sector ranking over the past 1, 3 & 5 years.

The investment funds that have maintained a high sector ranking consistently reflect the efficiencies and expertise of the particular fund managers. Fund Managers that have proven their ability to deliver competitive returns over both the short and long term. But as identified in this report, some of the largest and most popular investment brands have struggled to perform with the bulk of their funds.

How Efficient Is Your Portfolio?

This report identifies that the majority of investors are missing out on extra portfolio growth due to subpar fund choices leading to general inefficiencies in their portfolio.

Inefficient investing will undoubtedly have adverse long-term consequences. It is important to identify and correct any portfolio deficiencies.

Yodelar's free portfolio review service has helped thousands of investors identify areas for improvement. Our analysis will provide complete clarity as to the quality of underlying funds in any portfolio.

Our portfolio review service will provide an independent analysis of your portfolio and identify:

⇔ If your portfolio contains top, mediocre or poor performing funds

⇔ How your portfolio growth compares to a similar risk portfolio of top-performing funds

⇔ How efficient your fund choices you have been

⇔ Potential areas for improvement

⇔ An overall quality rating of your portfolio

Our portfolio analysis feature provides a clear insight into how each of your individual funds is performing while grading your portfolio based on its overall performance - making it easy to identify weak points or areas for potential improvement.

Click on the link below and find out how competitive your portfolios performance has been and if the advice you have received to date has been up to par.