On the back of a record 2017, Investment companies have seen their total assets under management hit an all-time high as more and more UK investors flock towards investment Trusts in the pursuit of higher returns.

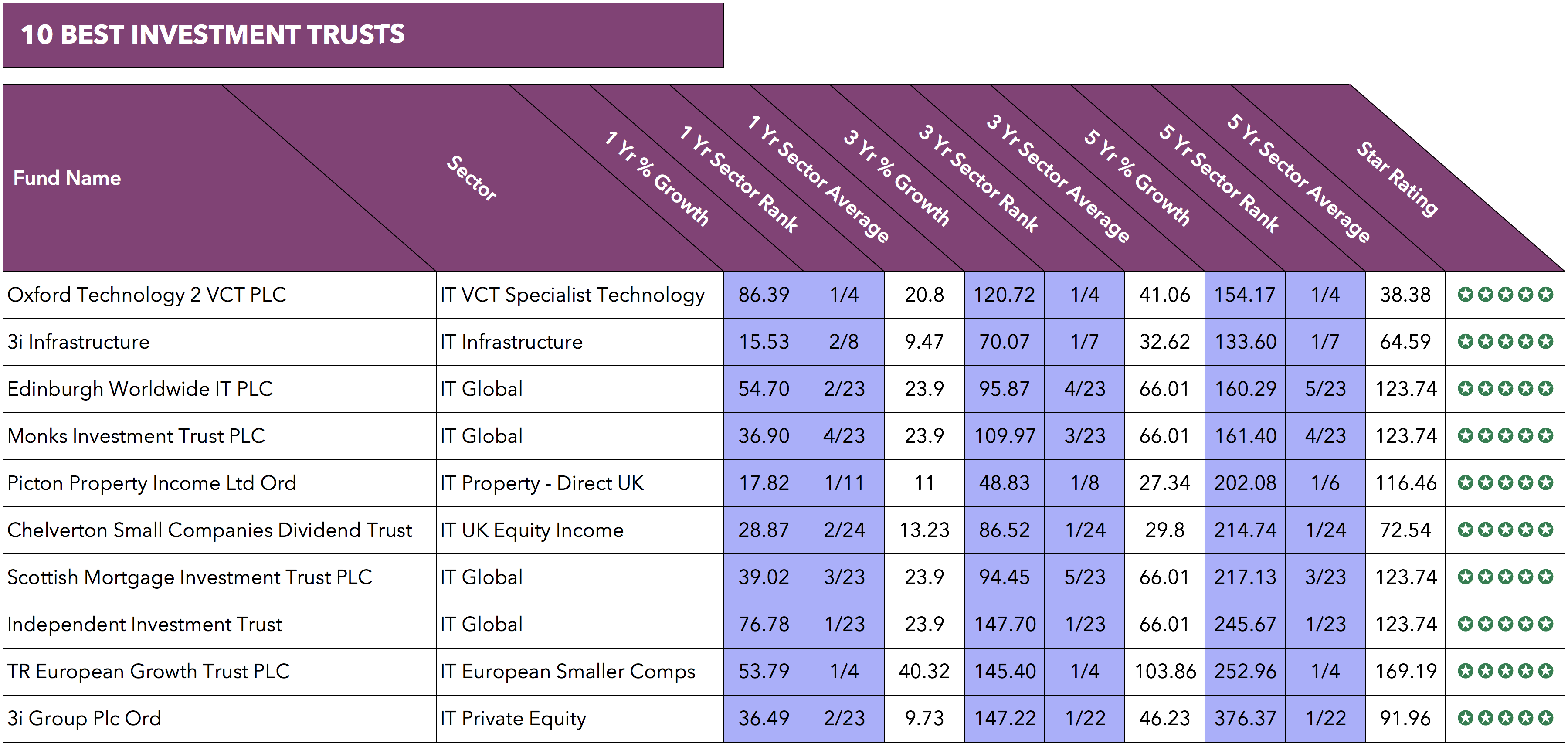

There are more than 450 Investment Trusts to choose from and to provide some clarity as to what investment trusts have performed the best we have broken down a list of 10 that have returned exceptional growth over the recent five years and consistently been among the top performing trusts in their sectors.

The 10 Top performing Investment Trusts in this report are not listed in any particular order.

Subscribe now for just £1 and get access to ALL premium reports including the best investment trusts and model top performing portfolios.

-

Oxford Technology VCT

VCT investing is only suitable for investors who are capable of evaluating the risks and merits of such investment and who have sufficient resources to bear any loss which might result from the investment. This

particular Investment Company is aimed towards investors who are looking for high risk/reward tax-efficient return from investing in science and technology companies. This high-risk specialist investment has returned growth of

high-risk specialist investment has returned growth of 86.39% in the 12 months up to February 2018, and over the recent five years, it has returned growth of 154.17%.

3i Infrastructure

The 3i Infrastructure investment company invests in a diversified portfolio of infrastructure companies with a focus on UK and Europe with the aim of providing its shareholders with a targeted total return of 8% to 10% p.a. over the medium term. However, with returns of 15.53% over the recent 12 months and with 5-year growth of 133.60% it was the top-performing Investment trust in the specialist sector.

Edinburgh Worldwide

Managed by Baillie Gifford, who have consistently been among the top performing fund managers in the UK, the Edinburgh Worldwide Investment Trust has returned growth of 54.70% over the recent 12 months. This Global focused company invests primarily in young American and UK entrepreneurial companies, and over the past five years, it has enjoyed strong growth in comparison to same sector companies, returning growth of 160.29%.

Monks Investment Trust

The Monks Investment Trust is another managed by Baillie Gifford. This popular company holds assets under management totalling £1.7 billion and similar to the Edinburgh Worldwide Investment Trust it competes within the Global sector. However, the investment focus of this company is considerably different as it aims to achieve capital growth by investing principally in a portfolio of global quoted equities.

Over the recent 12 months, the Monks Investment Trust returned returns of 36.90%, which although notably lower than that achieved by the Edinburgh Worldwide Trust it was still among the best in its sector. This company has consistently delivered top performance, and over five years it returned growth of 161.40%.

Picton Property Income

This UK focused investment Trusts objective is to provide shareholders with an attractive level of income together with the potential for capital growth, by investing in the principal commercial property sectors. This company has continually been the top performer in its sector over the recent 1, 3 & 5 years returning growth of 17.82%, 48.83% and 202.08% respectively.

Chelverton Small Companies Dividend Trust

Managed by Chelverton asset management, the Chelverton Small Companies Dividend Trust sits within UK Equity income based sector. This trust has consistently impressed, and with 5-year growth of 214.74%, it was the top performing fund in its entire sector over the recent 5-year period.

Scottish Mortgages Investment Trust PLC

The 3rd Baillie Gifford managed trust in this list is the Scottish Mortgages Investment Trust, which is one of the largest Investment Trust in the world with assets under management exceeding £6.6 billion. This 5-star rated Investment trust has maintained strong performance within the competitive Global sector. Over the recent five years, it returned growth of 217.13%, which was the 3rd highest in its sector and over the last 12 months it delivered returns of 39.02%, which again ranked 3rd overall within its sector.

Independent Investment Trust

The Company is an actively managed investment trust that invests in a diversified portfolio of assets. It aims for good returns over long periods, by investing the vast majority of its assets in UK and international quoted securities. Although of moderate size, holding assets under management totalling £339 million, the Independent Investment Trust has been the top performing company within the entire Global sector consistently over the recent 1, 3 & 5 years returning huge growth of 76.78% over the last 12 months, 147.70% over 3 years, and significant returns of 245.67% over the most recent 5-year period.

TR European Growth Trust

Managed by Janus Henderson investors, the TR European Investment Trust invests predominantly in smaller and medium-sized companies in Europe (excluding the UK) and sits within the small European Smaller Companies sector. Over the past five years, this company has enjoyed a continued strong performance, returning notable growth of 272.96% over the recent 5-year period. This trust holds a modest £646 million of assets under management, but with continued strong returns it is likely to see further inflows from growth-seeking investors.

3I Group Plc

The popular 3i Group Investment Trust aims to achieve long-term capital and dividend growth, by focusing on buyouts, growth capital, venture capital, infrastructure and quoted private equity investments across Europe, Asia and the US. Not only is this Investment Trust one of the World’s largest, with assets under management exceeding £6.7 billion, but it is also one of the best performing Investment Trusts available returning recent 5-year growth of 376.37%.

Although the 10 top performing investment trusts included in this report have consistently delivered high returns, they do carry relatively high levels of risk that may not be suitable for some investors.

View more Best Performing Fund articles and reports >>