In the wake of Donald Trump’s US presidential victory and a vote for Brexit Investment experts had predicted that 2017 would be a tumultuous year for investors - yet equity markets have seen record highs, and many UK investors have seen their portfolios experience large gains.

However, despite 2017 delivering record growth levels from equity markets such as UK, Europe and North America, some investment portfolios experienced muted performance and many UK investors missed out on greater returns simply because the funds they were invested in had underperformed.

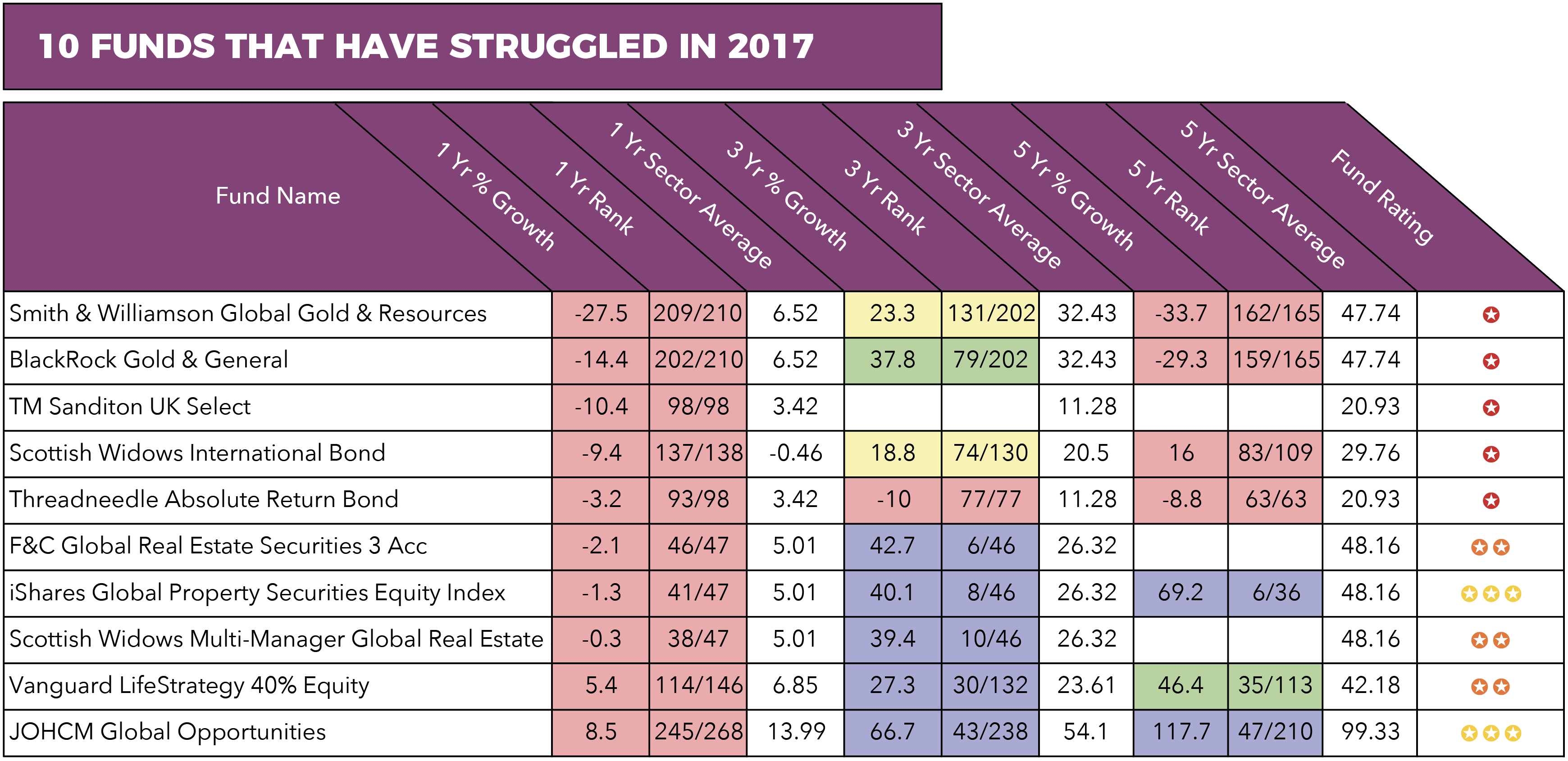

In this report, we highlight 10 funds that have struggled in 2017. They were selected from an analysis of over 3,100 unit trust and OEIC funds classified by the investment association and they represent some of the most disappointing funds of the year.

1. Smith & Williamson Global Gold Resources

The Smith & Williamson Global Gold Resources fund is invested in a spread of equities principally within the gold and precious metal industry and it currently holds a

relatively small £44 million. This highly volatile specialist fund has had a torrid year returning negative growth of -27.5% in the 12-month period up to November 2017.

2. BlackRock Gold & General

Currently more than £1 Billion of investor savings is held within the popular, yet high risk BlackRock Gold & General fund. Over the recent 12 months this fund has been very disappointing returning negative growth of -14.4%. However, despite being a favoured fund for many investors and financial advisers, it isn’t just 2017 were this fund has struggled. In the 5-year period up to November 2017, the BlackRock Gold & General fund has delivered negative growth of -29.3%. Therefore, if you invested £10,000 into this fund 5 years ago your investment would now only be valued at £7,030 - a loss of almost £3,000.

3. TM Sanditon UK Select

The TM Sanditon UK Select fund was launched almost 3 years ago and is managed by Thesis asset management. Thesis, currently have over £13.6 billion of investors savings under their management, of which the TM Sanditon UK Select fund holds a small £23.4 million. This fund is one of 98 funds that sits within the Targeted Absolute Return sector. This sector has not fared particularly well in 2017, with average 12-month growth of just 3.42%. However, with negative growth of -10.4%, the TM Sanditon UK Select fund was the worst performing fund in the entire sector over the recent 12 months.

4. Scottish Widows International Bond

The Scottish Widows International Bond was launched in 1993 and its objective is to deliver its investors income and long-term capital growth by investing in government and other fixed interest securities from anywhere in the world (apart from certain areas within South East Asia). This fund is 1 of 138 funds within the Global Bonds sector and with £859 million of investor savings held in this fund it is one of the largest in the entire sector. However, despite its size, over the recent 12 months the Scottish Widows International Bond has been the worst performing fund in its entire sector returning negative growth of -9.4%.

Access the most recent Scottish Widows fund review >>

5. Threadneedle Absolute Return Bond

The Threadneedle Absolute Return Bond is a low volatility fund that sits within the Absolute Returns sector. Threadneedle have stated that their objectives for this fund is to consistently deliver a positive return over a 12-month rolling period. Indeed, it has been consistent but unfortunately for those invested in this fund, its performance has been consistently poor. Over the recent 12 months this fund returned negative growth of -3.2% and over the recent 5-year period it ranked 63rd out of 63 funds in its sector with negative growth of -8.8%.

6. F&C Global Real Estate Securities 3 Acc

Since its launch in December 2013, the F&C Global Real Estate Securities 3 Acc fund has been a relatively volatile and inconsistent performer. 2016 proved to a be a strong year for this fund as it returned 26.5% growth but in contrast 2017 has been a disaster. Over the recent 12 months the F&C Global Real Estate Securities 3 Acc fund ranked 46th out of 47 funds in the Property sector with negative growth of -2.1%.

7. iShares Global Property Securities Equity Index

Managed by BlackRock, the world’s largest fund manager, the iShares ETF range currently has more than $1 trillion of assets under management. The iShares Global Property Securities Equity Index fund is an ETF that aims to achieve capital growth by tracking closely the performance of the FTSE EPRA/NAREIT Developed Index, the Fund’s benchmark index. This popular fund holds a significant £1.75 billion of investor assets and up the end of 2016 it had been one of the top performers in its entire sector. However, the past 12 months has been a difficult period for this passive ETF as it returned negative growth of -1.3%, which was worse than 87% of competing same sector funds. This funds’ performance over the past 12 months was also notably lower than the sector average of 5.01%.

8. Scottish Widows Multi-Manager Global Real Estate Securities

Similar to the iShares Global Property Securities Equity Index fund, the Scottish Widows Multi-Manager Global Real Estate Securities fund sits within the Property investment sector. This fund had also enjoyed a period of comparatively high returns within its sector but with negative growth of -0.3% over the past 12 months, 2017 has proven to be a difficult period for this popular fund.

9. Vanguard LifeStrategy 40% Equity

Through their popular LifeStrategy range of funds, Vanguard have taken in almost £10 billion of investor assets. The 2nd largest of their LifeStrategy range of funds is their LifeStrategy 40% Equity fund, which alone has assets under management that exceed £2.36 billion. Since its launch in 2011, this fund has maintained a respectable level of performance in comparison to competing same sector funds but over the recent 12 months its performance has seen it slip down the sector rankings. The Vanguard LifeStrategy 40% Equity fund is 1 of 146 funds in its sector and over the recent 12 months it returned growth of 5.4% which was worse than 78% of funds in its sector. Despite its below average performance in 2017, investor confidence in this fund remains strong as it continues to grow in size.

10. JOHCM Global Opportunities

The investment objective of the JOHCM Global Opportunities fund is to deliver long-term capital and income growth through a concentrated portfolio of global equities, and up until this year it had been delivering very competitive returns for its investors. In fact, over the recent 5-year period it has returned growth of 117.7% which was greater than 78% of competing funds within the same sector. However, the past 12 months has been a difficult period for the JOHCM Global Opportunities fund as it only managed to deliver growth of 8.5%. On the surface this may seem respectable, but the average growth returned by same sector funds was a considerably greater 14%. Also, the level of growth it returned was worse than 91% of the 267 other funds in the same sector.

Each of the 10 funds listed have factually been among the worst in their sectors over the recent 12-month period.

However, political uncertainty or changing market conditions can influence the performance of a fund both in the short term or in the long term. Therefore, although a fund may have experienced poor performance in 2017, over a longer term and as part of a diversified portfolio they could potentially be competitive investment opportunities.